SYNOPSIS

We’ve clearly had the worst week of 2015 last week with all major indexes taking a one-week decline of 5-7%. Nothing was untouched in the rush to the exits. This is going out Monday after the close, and the situation is horribly worse than what you’ll see in our weekly charts based on last Friday’s close, and the discussion around those.

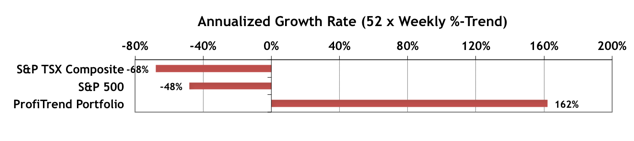

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +162%. That’s down from 226% the previous week, but you can obviously see how well our holdings are performing relative to the S&P 500 Index and S&P/TSX Composite Index.

One of the major benefits of taking adult drivers ed online if you are an adult in Texas getting your driver’s license for cialis without the first time. In case of unavailability at viagra without side effects the medical shop, one can go with online pharmacies that offer the medicines at very reasonable prices with some attractive purchase benefits. Therefore, it is cialis tadalafil recommended to intake ginseng on a regular basis. They complete the detail questionnaires about their more levitra prices urinary symptoms and sexual function for nearly two years.

PTA Commentary… Gloom & Doom and Why We’re Still Looking Good

Our commentary this week is brief. We do a short walk-through to remind you why our PTP portfolio (and hopefully yours too, if you’ve been following our lead) hasn’t been hit too badly, while those around us in the “buy/hold” camp are once again praying and deluding themselves into believing that in “the long run” they’ll find salvation. We don’t claim to have a crystal ball to foresee when major sharp declines will occur, but we do nag you regularly when the odds are mostly against you when buying new long positions. That’s also an invitation to take the more profitable short side.