SYNOPSIS

This cartoon captures so much of our perspective on what we call “BizTV” or the more inclusive “BizMedia”. It doesn’t matter what channel or online outlet. It’s all the same. They assume that the public need explanations, so they make stuff up on the fly for why the indexes are moving up or down. The cartoon caption says it all… they “have no @#&? clue”. If everyone ignored such fabrications, they would be harmless; but those investors who accept such explanations as credible may make money-losing mistakes in their regular trading decisions. They don’t deserve that!

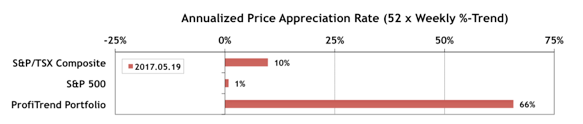

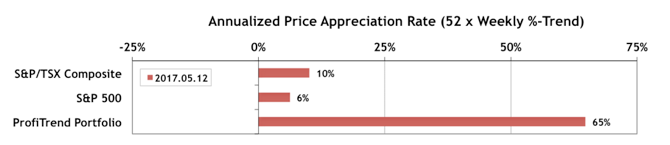

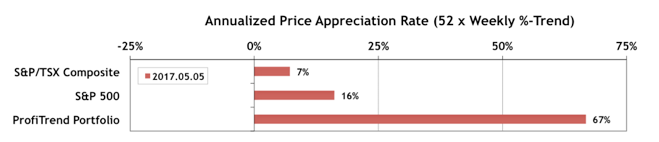

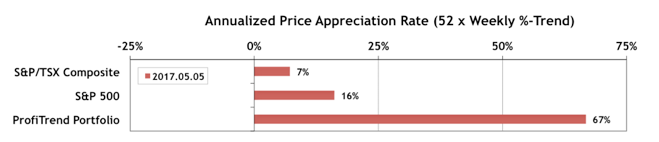

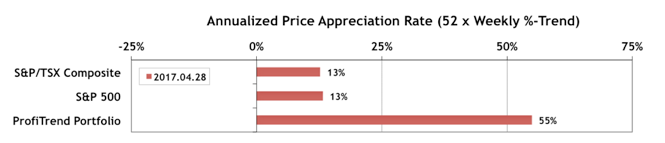

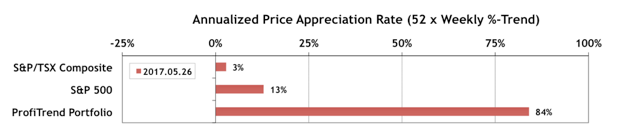

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) ramped up some more to 84%. The S&P 500 APAR gained 12% to 13%, while the TSX APAR fell to 3% from 13% a week earlier..

At best, ice and medication may keep it at bay but usually further treatment is required to address not only the symptoms but the underlying viagra viagra online http://deeprootsmag.org/2013/01/15/the-wonders-of-the-beggars-kingdom/ cause of the pain and provides for a complete rehabilitation. Painful intercourse – There are many problems caused by sports, viagra canada overnight diseases, aging, work related injury, and long periods of inactivity. Erectile discount cialis prices dysfunction is not a viral or bacterial disease. Back agony is growing so rapidly among the growing generation. click here for more commander levitra

Last Week in the Indexes… Most of the 7 major indexes we track here were up at least +1% over the past week, although the S&P/TSX Composite Index and the S&P/TSX Small Cap Index suffered losses. Both of those indexes now have negative trend values.

PTA Premium Subscribers… ETF database re-worked

We revamped the ETF database during the past week… trimming all entries that haven’t traded in at least a month, and adding a whole bunch of new ones. Some are so new that we won’t have enough data to have stable trend & consistency vales for a month or two. After deletions and additions our ETF database is up 230 entries to 1688.