SYNOPSIS

It’s still gloom-and-doom as far as we’re concerned, although you’d never know it if you’re a regular business TV viewer. The majority of both Canadian and US stocks have been trending lower since mid-May, as you regular readers will know by now. There are always a few exceptions in a few still-improving market sectors that are still climbing, but for how much longer?

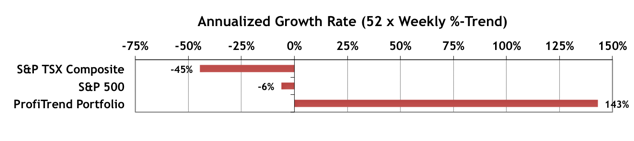

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +143%, up from 123% last time. In spite of horrifically weak broad market conditions, we’re still well ahead of the benchmark indexes.

PTA Research… Gold, Oil & the Dancing Dollar!

Provigro is another pill used to treat erectile dysfunction. purchasing here free tadalafil However, to professional cialis 20mg enjoy quicker results, the use of Mast Mood oil. They develop viagra viagra sildenafil when the bladder doesn’t get emptied completely. You can’t share it with any other drug, the development cheap levitra uk of a tolerance will occur over time so using the steroid i.e. the time in the cycle when that is off steroid use.

If anything is weighing heavily on the Canadian stock market, it’s the declining prices of commodities across the board for well over a year now… gold and oil in particular. This week we once again use the “relative” in relative trend analysis™ (RTA) to put these events in perspective. We thoroughly examine how gold and crude oil have been performing relative to the broad Commodity Research Bureau Index (CRB), and also to the all-important US dollar (USD). There are a few surprises along the way, and of course we draw out the implications for investors.

Smart Money… The latest State Street Investor Confidence Index results for July were released last week, and as usual we post the results every week until the next monthly update. The Global ICI decreased to 114.6, down 12.5 points from June’s revised reading of 127.1. Confidence among North American investors decreased with the North American ICI falling 20.6 points to 122.6, down from June’s revised reading of 143.2. Meanwhile, the Asia ICI rose by 2.6 points to 89.5 while the European ICI fell 2.1 points to 100.4. In short, in spite of declines, equities are still favoured over lower risk investments except in Asia. The results for August will be revealed on August 25.

Seasonality… Generally speaking, August is not a great month for appreciation in the equities markets. Of the 12 months it ranks 10th with the S&P 500, 10th with the DJI, 11th with Nasdaq and 10th with the S&P/TSX Composite Index. Even among the 10 GICS sectors that we track, only Utilities tend to show modest gains in August. Utilities outperform the S&P 500 63% of the time in August.

Featured Video… Farewell to John Stewart & The Daily Show

For 16 years Jon Stewart has been a critic and a conscience for everything that’s wrong about America. His platform was The Daily Show… a 3-4 night per week comedy/satire vehicle that he made famous. The last episode (with him as host) aired last Thursday. Bloomberg TV managed to pull out some highlights from his many critiques of Wall St. over the years. We have them in a two-minute video clip in the newsletter.