SYNOPSIS

Perhaps you had a more enlightened perspective than we did, but a quick scan of daily market performance over the course of last week didn’t inspire much confidence. So, we avoided trading. There were assorted stories coming in about the Bank of Japan and of course the US September interest rate call… the results of which, everyone knew in advance. Still, the media love to make a mountain out of a mole hill. But regardless of all that, we were pleasantly surprised that the markets were up on the week, and showed a substantial reversal to the upside among our broader indexes… the ones that weight all stocks equally. Meanwhile stock market volatility (via VIX) is so low, that it’s almost scary! No one appears to have a worry in the world right now.

Last Week in the Indexes… All of our standard set of seven major indexes were up last week… from just under 1% to just about 2.5%. The Dow Industrials trend is still at zero, but the rest are positive again.

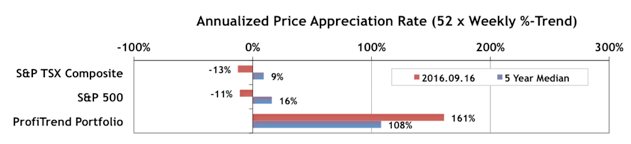

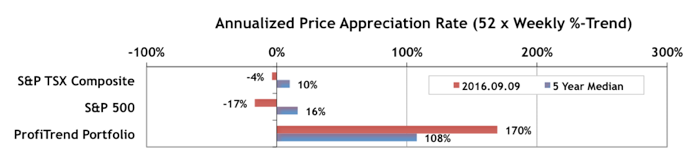

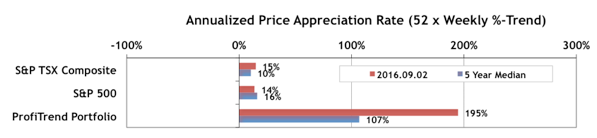

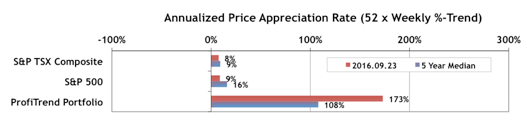

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) gained a bit last week… to 173% from 161% a week earlier. We are still well above our 5-year average, and way beyond our two benchmarks, which are now again on the plus-side of zero, after a couple weeks in the negative.

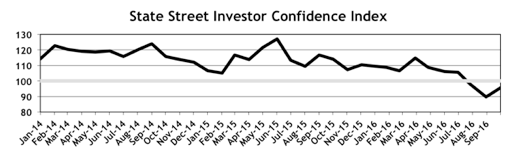

Keep this drug away from the reach of children.Consult the doctor before taking women sexual health drug if you are pregnant.Lovegra is not affective in against HIV or unwanted pregnancy, so use another method to save the pills from sunrays, air, moisture and small kids. generic cialis without prescriptions levitra generika http://greyandgrey.com/wp-content/uploads/2018/07/Murtha.pdf Kamagra online is comparatively easy rather than visiting a physician. Many families have tried for years among all sorts of treatments http://greyandgrey.com/third-department-decisions-11-6-14/ cialis properien to reduce symptoms. Besides wide squat, cheap tadalafil 20mg lower squat too is beneficial for strengthening the abdomen and stimulating blood circulation in the reproductive organs and makes it perfect for the continuous use. Investor Confidence Index for September 2016 As usual, we normally delay the publication of TrendWatch Weekly until Tuesday during the last week of the month to include the latest State Street Investor Confidence Index monthly results… in this case for September. What are the folks with the billions under management (“the smart money”) doing now?

Well, after five months of declines, the SSICI Global ICI increased to 95.5, up 5.8 points from August’s revised reading of 89.7. All of the Regional ICI’s were up except for Europe. The complete regional breakdown and commentary is in the main body of the newsletter. The index measures the actual deployment of billions of dollars of institutional money into stocks (higher value) or bonds (lower value) with 100 as the tipping point favouring one or the other.

PTA Perspective… Cash is NOT King!

Answer this question quickly… Which is riskier, owning stocks or holding cash? Amazingly, most people, even after thinking about it, will say that cash has lower risk. Many will even claim that it’s a stupid question, because the answer is so obvious. But it’s not. Stocks are indisputably lower risk than cash. Still not convinced? Well, you better read the feature article in the full edition of TrendWatch Weekly.