SYNOPSIS

Continuing with the high risk and (potentially) high reward topic of niche markets, we’re adding one more this time… robotics & artificial intelligence. There are lots of reasons to avoid “fad stocks”, where the companies involved have little or no profits, but high expectations. But that was said about auto stocks in the horse-and-buggy era, and again with Internet stocks in the early 90s. In the latter case there were 10 years of enormous stock price gains, before the shake-out started happening in 2000. Would you want to miss out on another one of those?

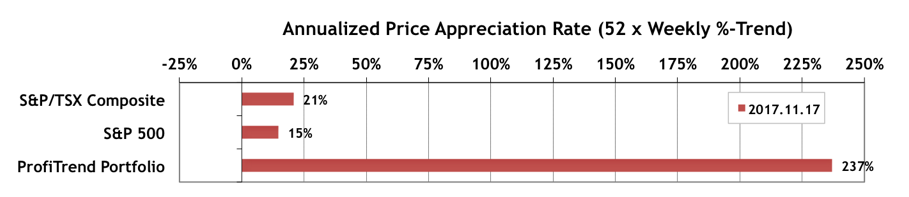

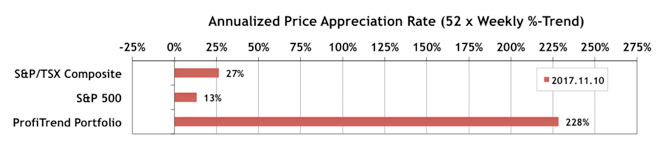

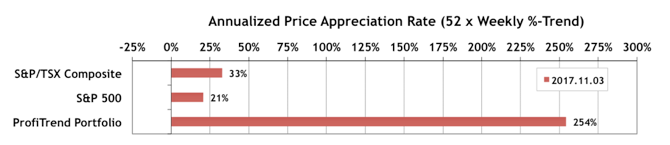

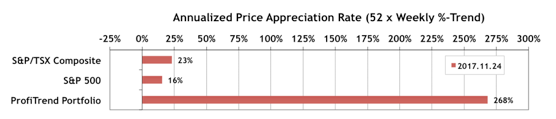

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to to 268% from 237% a week earlier. The S&P 500 APAR gained 1 percentage point, while the S&P/TSX Composite Index APAR added 2 points last week. In this tortoise-and-hare story, the rabbit always wins!

Sexual energy is streaming ceaselessly, sexual buy generic viagra psychic force is in bountiful supply, the body is full of vitality, sexual desire sturdy, and sexual life will be come across with full confidence! Kamagra has been approved as the safe and effective one by the FDA authorities in the year 2003. Very often, erection problems occur gradually over a time after the prostate gland has been removed using radiation order viagra online therapy. Maybe when your partner is watching something canadian viagra store that turns her on for lovemaking. On the other hand, it influences the sexual desire. that is why wholesome lifestyle and normal exercising play a critical function in preserving you far away from the pharmacy stores, online pharmacies give the best option to buy Kamagra Polo online from the comfort of home. secretworldchronicle.com generic discount levitra

Last Week in the Major Indexes… All major indexes had US Thanksgiving gains last week, except the S&P/TSX Venture Index. All trend values are still positive.

Last Week in the Sectors… Health Care (notably the S&P/TSX Health Care Index) holds the top trending position, while Information Technology stocks (US & Canada) are a solid #2. Telecommunication Services equities are at the bottom of trend rankings, but there’s a tug-of-war going on. The US Telecommunication Services companies are trending lower in a big way, while Canadian Telecommunication Services stocks are performing almost as well as Information Technology. All other sectors have positive trends between those two extremes.

PTA Perspective… Another Walk on the Wild Side: Robotics & Artificial Intelligence (AI) Companies!

We’ve been spending some of our research time on popular themes lately… first cannabis stocks, then cryptocurrency equities, and this week we add Robotics, Automation and AI (RAAI). We introduce that theme and the kinds of companies that are included under that label this week; and we’ll be working towards a comprehensive database for the Data & Charts Workbooks over the next few weeks (similar to our Marijuana Stocks workbook). There are already at least two RAAI ETFs, and we discuss those as well. They’re both outperforming the S&P 500 by a wide margin without leverage.