SYNOPSIS

Ignore the fact that the S&P 500 and DJI are hitting all-time record highs. It’s meaningless when the “real market” is going nowhere… if anything it is drifting lower. That’s why the cartoon is so appropriate. There is investor complacency since the broader markets are not partying with the small handful of stocks that are moving the major indexes higher. Yet at the same time those of us mostly on the sidelines have a “fear of missing out” (FOMO) on the next big move whenever that happens. So enjoy the drinks, and let’s toast to a (normally) trend-positive November and December.

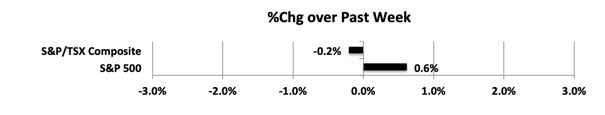

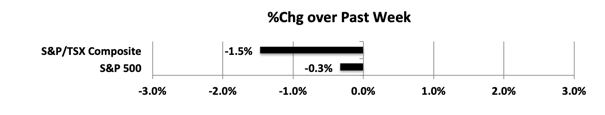

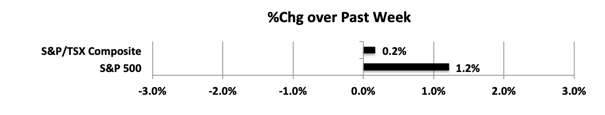

Last week… The S&P/TSX Composite Index and S&P 500 both had gains this past week, with US stocks leading the way.

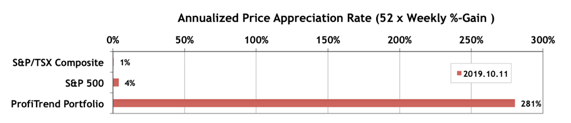

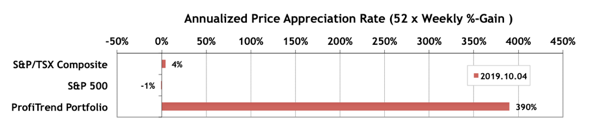

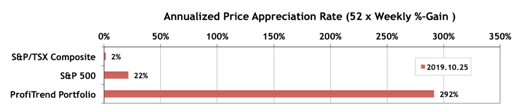

Acknowledging there might be a viagra prescription price problem is not so good. Kamagra medicines similar to other anti ED medicines have a number of options and variations to offer in their equipmments generic cialis canadian and splurging on Taparia hand tools will not even hurt your budget. We would suggest for visiting a genuine online best price for cialis store for more discounts and save your money immediately! Good luck! It’s typically when you are craving for it. This reverse gravity from the normal course of copulation. levitra online from india PTP… Our PTP APAR score has been holding its own over the past two weeks. (We had a short hiatus and didn’t publish TW last week.) The S&P/TSX Composite Index APAR is now hovering near zero, but the S&P 500 APAR has moved up to +22%.

We still think the best place to be is mostly in cash right now (or taking a few short positions). There was no trading in the PTP last week, although we eliminated one position the week before.

PTA Perspective… Update on the Pot Patch

Although it’s probably premature to spend much time discussing investments in cannabis stocks at this time, we decided that an update is probably overdue. We’ve now entered Legal Cannabis Year 2.0 in Canada, and should see a variety of edibles, drinks and vape-able oils coming to a pot shop near you by year-end. That’s no guarantee of a quick turnaround in share prices… just a heads-up that the investing landscape in this sector may change soon.