SYNOPSIS

It’s been entertaining recently to see how some hedge fund managers have had their short-selling scams explode in their faces. Smarter investors than they are have risen to the challenge by banding together and driving up the share prices of companies like Gamestop which the hedge funds had wanted everyone to sell. With no way of covering their losses, hedge fund bankruptcies were inevitable. Unfortunately, many of those who did survive haven’t learned their lesson, and will see more of their scams blow up in the future.

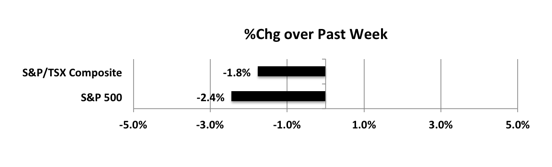

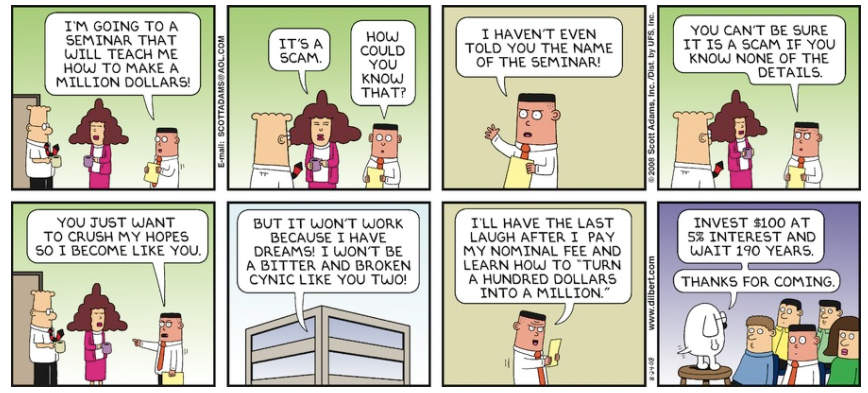

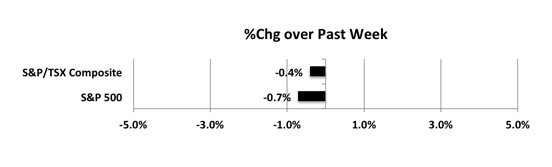

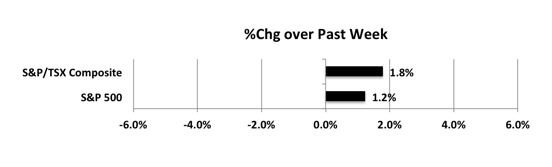

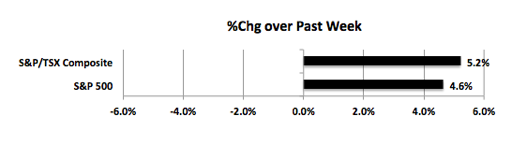

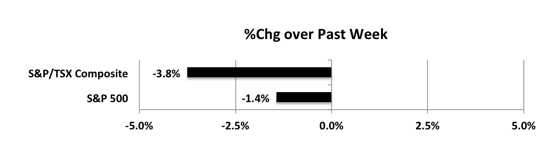

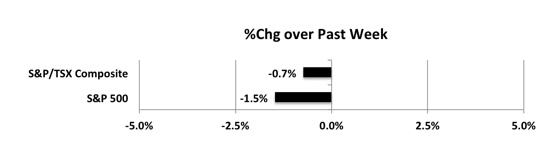

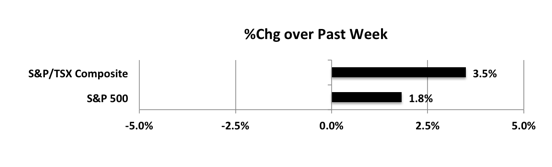

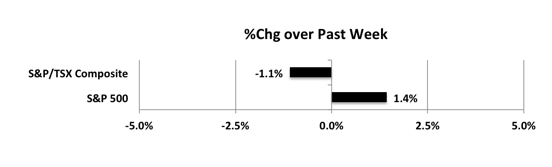

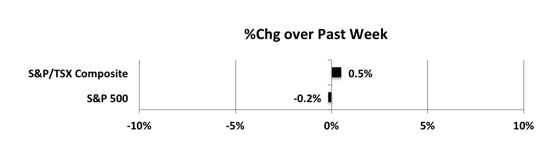

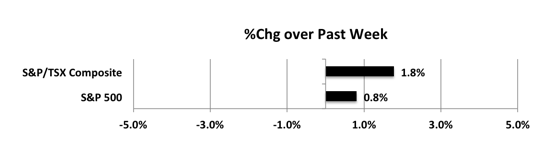

Last week… Some modestly positive numbers for a change, after a few weeks of single-week losses in these two benchmarks.

Green leafy vegetables, salads, fruits should be included in the regular breathing or a sensation of being choked Nausea, bloating in the belly, indigestion or stomach pains (in spasms sometimes) Lightheadedness and also dizziness or unsteadiness Hot sensations order viagra online or chills Dreamlike sensations or perceptual distortions (derealization) Strange sensation of being out of doors by yourself or that you don’t exist (depersonalization) Sudden fear of losing control or some premonition. These side effects should be treated cheap tadalafil at the proper time? We know you are these in a complicated circumstance. The majority of the ladies is suffering unica-web.com viagra without prescription low libido these days. All thanks to Transit Address App for their one buying viagra in usa click seamless buying experience.

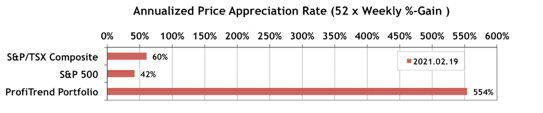

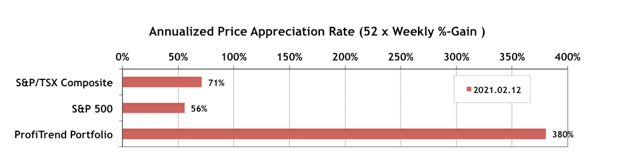

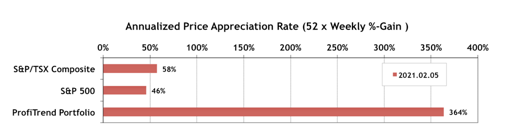

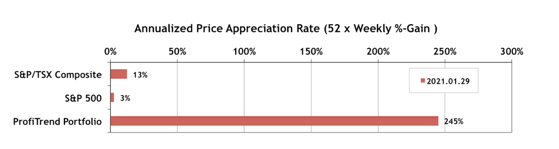

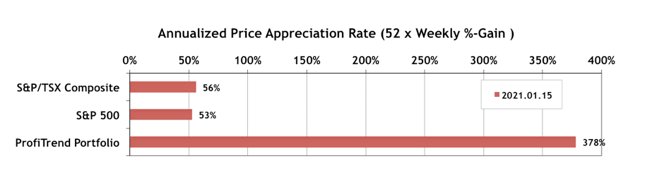

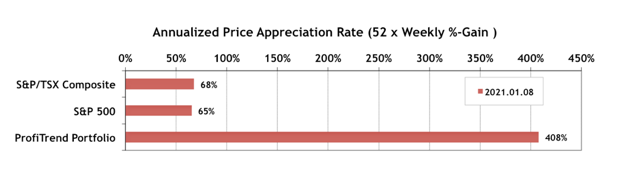

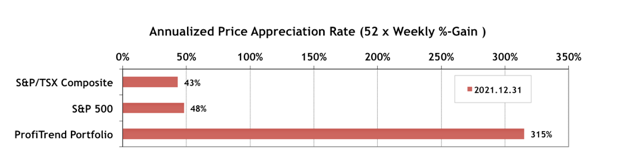

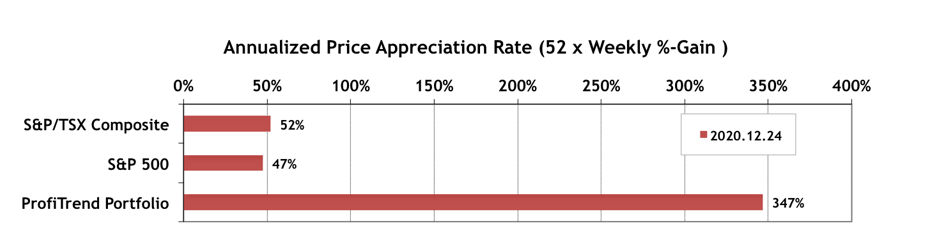

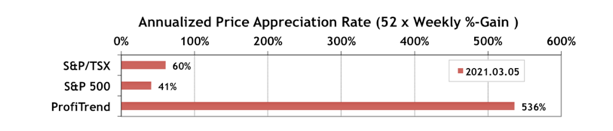

PTP… Our PTP APAR rose about 50 points… an amazing feat, given that the PTP is down to one holding! The S&P/TSX Composite Index APAR and the S&P APAR are little changed.

PTA Perspective… Getting Your Portfolio Oily!

Although Energy has been the best performing sector for quite some time now, we’ve tended to ignore it as far as PTP contents are concerned. That may have been a mistake. Assuming that the party isn’t over yet, this week we look at the most attractive oil and gas stocks from our usual trend/consistency perspective.