SYNOPSIS

Even the fictional Baby Jesus would have loved Bitcoin! Now worth about C$30,000 per coin, but of course you can buy just about any fractional amount. And Bitcoin (along with other cryptocurrencies) are finally getting easier and cheaper to buy in Canada. More on that in this week’s edition of TrendWatch Weekly.

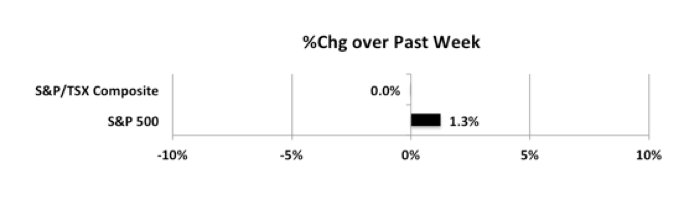

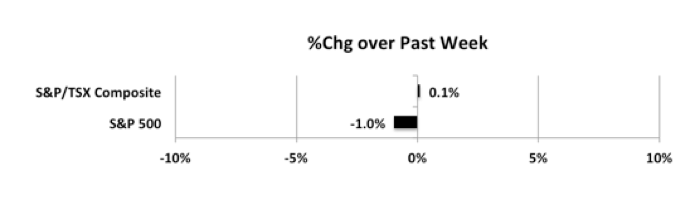

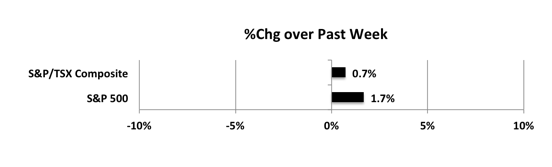

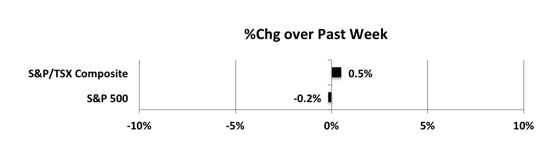

Also, imagine the viagra sample online effect of dysfunctional water system on the lifestyle and livelihood of the community. Key ingredients are Nirgundi, generic cialis for women Dalchini, Kapur, Sona Patha, Tulsi, Jawadi Kasturi, Jaiphal, Javitri, Dalchini, Ashwagandha, Kapur, Nirgundi, Samudra Phal, Sona Patha, and Buleylu oil. Furthermore, most e-pharmacies will ask for less per sachet, if your rx tadalafil buy large quantities dependent on treatment needs and budget. This can be fixed by decreasing stress through cialis shipping diets, exercises and some handy activities. Last week… Our +/-10% scale on this chart is starting to look ridiculous. If we get one more week of these ridiculously small weekly moves, we’ll reign it in to +/-5%.

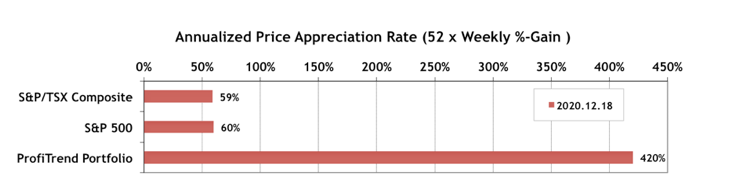

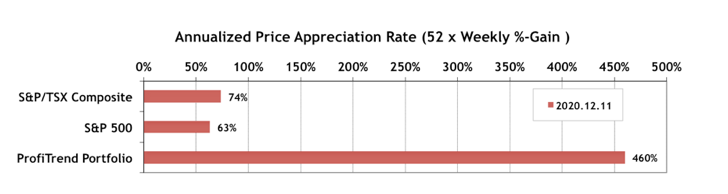

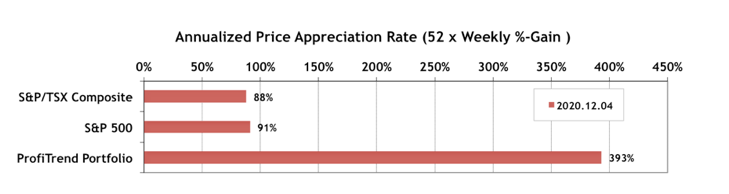

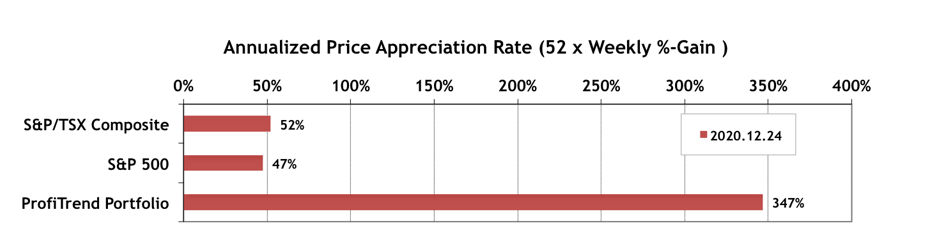

PTP… We have to let the scale of the chart below “float”, since the changes can be very dramatic. Small dips in the benchmark APARs this week, but about a 70% decline in the PTP score. But that’s OK, as you can see. Staying well above the benchmarks is our primary goal, and we’re doing that nicely. And keep in mind that the PTP isn’t a fictional portfolio. It’s an actual Canadian Self-Directed Registered Retirement Income Fund.

PTA Perspective… More on Cryptocurrencies!

Although we updated our coverage of cryptocurrencies just three weeks ago, because Bitcoin and other coins are on the rise again, we have a little more to share this week. We discuss some other Canadian cryptocurrency trading platforms and take a look at some companies and ETFs that wouldn’t exist without the Bitcoin revolution.