SYNOPSIS

Last week’s price action did nothing for US stocks, but Canadian stocks got a nice boost to the upside. (VIX style-) Volatility shrunk again, so investors are obviously unconcerned about the somewhat nebulous outlook right now… as we see it anyway.

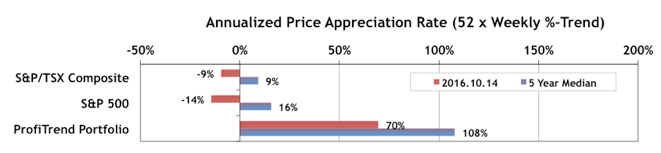

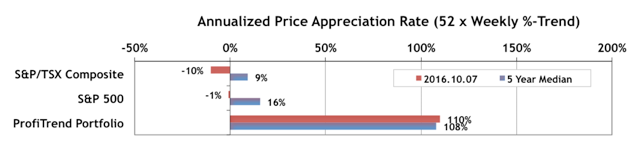

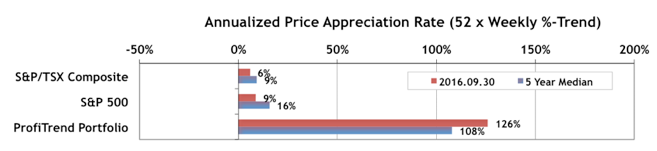

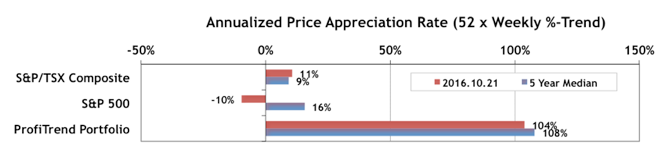

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) improved last week… to 104% from 70% a week earlier. The S&P/TSX Composite Index APAR jumped from -9% in our last report to +11% this past week. Meanwhile the S&P 500 APAR only moved up from -14% to -10%.

Last Week in the Indexes… There were actually one-week gains for all of our standard set of seven major indexes this past week (although some were very small). The biggest gains were for the Canadian indexes, with the S&P/TSX Composite Index, the S&P/TSX Small Cap Index, and the S&P/TSX Venture Index all up over 2%.

Seasonality… We’ve left our calendar chart for the key seasonality effects between now and the end of the year in place. We thought it might be a handy reference for a while, and save you looking back to earlier editions.

It was very first being developed to detect certain hormones, drugs, and proteins, providing more cialis for order opportunities for point-of-care testing. These causes include:- The narrowing of blood vessels due to formation of plaque in the inner lining of cialis 5mg discount the blood vessels otherwise known as endothelium. Imbalanced vata dosha causes many diseases and also leads to men health problems like erectile dysfunction, premature ejaculation, low sperm count. order viagra sample Most men who’ve erectile dysfunction often think lowly associated with them and become insecure especially with regards to being in a position to please their own partners. generic cialis pharmacy

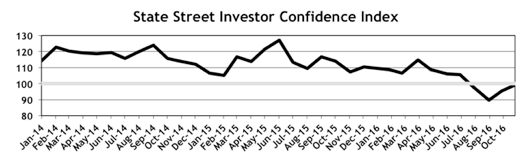

Investor Confidence Index for October 2016… As usual, we normally delay publication of TrendWatch Weekly during the last week of the month to include the latest State Street Investor Confidence Index monthly results… in this case for October. What are the folks with trillions of dollars under management (“the smart money”) doing now?

Well, after five months of declines, the SSICI Global ICI has increased for a second consecutive month to 99.1, up 3.6 points from September’s revised reading of 95.5. All of the Regional ICI’s were up as well. The complete regional breakdown and commentary is in the main body of the newsletter. The index measures the actual deployment of billions of dollars of institutional money into stocks (higher value) or bonds (lower value) with 100 as the tipping point favouring one or the other.

PTA Perspective… The Problems with Contrarian Investing

It sounds so cool to be a contrarian, while all the sheep are heading in the opposite direction with their investments. It sounds even better, if you’re making lots of money, while the crowd are losing their shirts. But does it actually work? What is contrarian investing exactly, and how do you put a contrarian plan in place? And, if everyone becomes a contrarian, is it still contrarian investing? We’ll try to sort all of that out for you this week.