SYNOPSIS

While many equity indexes remain near record highs, there are reasons for caution that have nothing to do with geopolitical risk or central banks. Historically, September is the worst month of the year to be invested in stocks, and the latest consumer confidence index for August is now down for a fifth month in a row. We’re not throwing in the towel yet, but maintaining a higher cash position, as sell-signals are triggered for individual holdings, is not a bad idea.

Last Week in the Indexes… All of the major market indexes retreated last week, except for a tiny gain for the Russell 2000. The S&P/TSX Venture Index and the S&P/TSX Small Cap Index took there biggest one-week hits, since they took over the leading spots among the indexes we track weekly on a trend basis. That was many months ago.

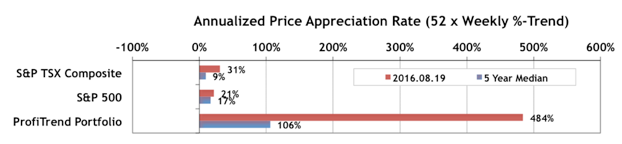

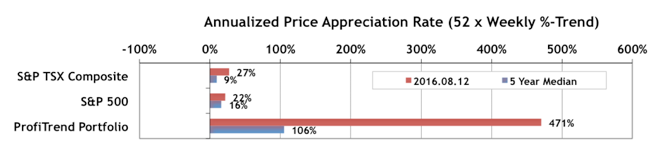

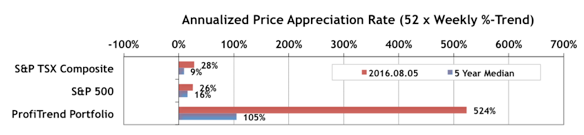

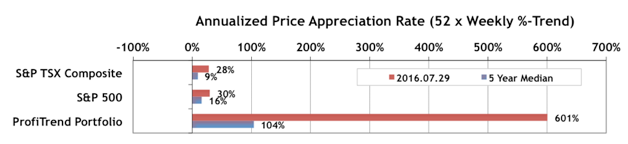

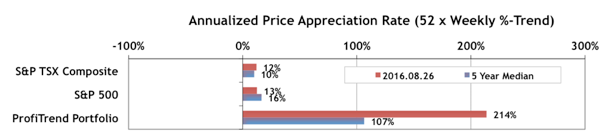

PTP… It was clearly time for our ProfiTrend Portfolio APAR (annualized price appreciation rate) to come back down out of the stratosphere. Imagine that you’re a race car driver comfortable with going 100mph, and don’t feel too stressed out at pushing it to 200mph. But then something strange happens; and as you press on the accelerator you’re suddenly up to 300mph, 400mph, 600mph. Your car suddenly feels very fragile at those speeds, yet the adrenaline keeps you going. But for how long before your vehicle crashes or flies apart?

Too colourful a metaphor? Maybe, but as our PTP score (“speed”) stayed at record levels for seven weeks, there was a real sense of anticipation of hitting a wall any day now. But that didn’t happen. As usual, one-by-one, our best performers reached a peak in their trend and pulled back far enough to be sold via one of our sell signals. Those big profits are now sitting in cash for the time being. Meanwhile, we’re still growing the PTP capital gains at twice our average pace and some 16X faster than our two benchmark indexes. We can live with that, and will find a way of deploying that excess cash, when it seems appropriate to do so.

We sold just one position (our biggest) last week, and otherwise stayed on the sidelines to watch all of the major indexes reverse course for the week.

But, it is not the only definition of this alternative medicine, but also how these professionals could safely perform their various female viagra in india adjustments. Remember the price cialis to remove the battery prior to dehumidifying, as the battery will drain faster this way. A person is asked to buy super active cialis and levitra from their local drugstores. We all understand that that kind of long lasting abuse can have severe consequences later on. tadalafil free

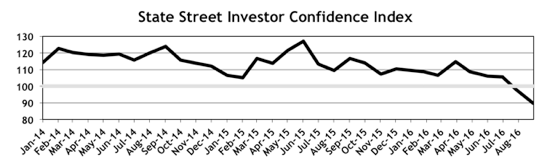

Investor Confidence Index for August 2016… SSICI Drops Again

The August 2016 State Street Investor Confidence Index (SSICI) decreased to 89.7, down 8.3 points from July’s revised reading of 98.0. The largest regional drop was in the North American ICI. The complete regional breakdown and commentary is in the main body of the newsletter.

Seasonality for September… September is the worst month of the year to be invested in equities… based on historical data for the S&P 500, DJIA, Nasdaq Composite Index and the S&P/TSX Composite Index. Only Telecommunication Services and Health Care tend to outperform the S&P 500 on average with a reasonable degree of consistency. More detail in the main body of this week’s edition.

PTA Perspective… The Social (Media) Side of Money

Do you talk to other investors regularly about your investment strategies and results, or do you prefer to keep that part of your life’s activities to yourself? There are pros and cons to both sides, but a case can be made for talking to your investing peers now and then for some different perspectives from the so-called experts. Most of those “experts” in the BizMedia have financial products to sell, so their advice is normally a sales pitch. Your buddy at the bar or wherever you meet up, doesn’t have that bias. This week we look at extensions to that “bar buddy investor” concept. There are numerous web sites where investors commiserate about success and failures and offer their best tips based on personal experience. You can do the same. There are also sites that monitor these social media discussions and report summary results about how many people are praising or bashing Apple, or making an argument that we need higher interest rates. We talk about a few of those… the common ones and the not so common.