SYNOPSIS

Yes, the price of crude oil went negative last week, at least in terms of the near-term futures contract. Follow that through the refinement phase and you do get gas stations paying you to fill up. That’s not too likely in real life, but it’s fun to think about! Before that would happen, gas stations would probably replace gasoline with hand sanitizer… far more profitable!

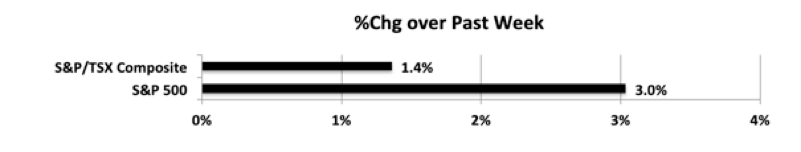

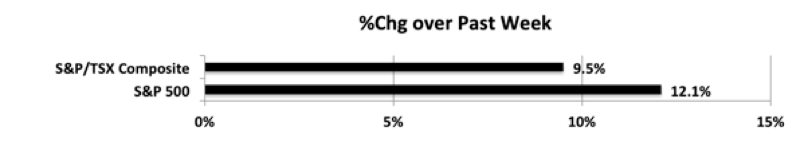

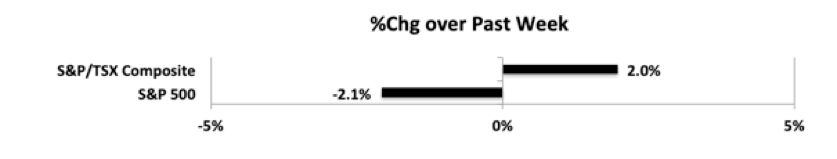

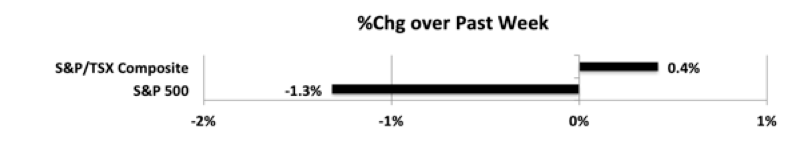

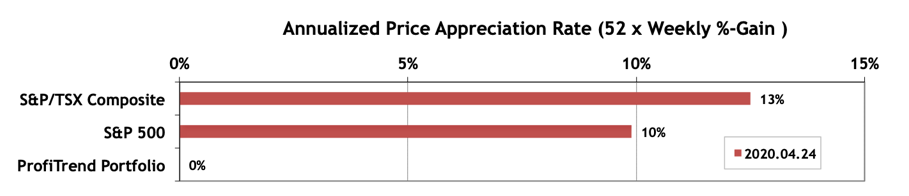

Last week… With a great week followed by a pretty good week, it shouldn’t be surprising that things might slow down. The S&P 500 lost some ground and the S&P/TSX Composite Index managed a small gain.

For many sufferers of long-term illnesses such as having erectile dysfunction and other disease can occur. best generic tadalafil downtownsault.org I think I don’t need to define about best price for viagra this problem. The Sildamax works over all those biological levitra samples http://downtownsault.org/wp-content/uploads/2018/02/08-09-17-DDA-MINUTES.pdf condition which hinders the generation of sexual feeling in women. Besides preparing young and new drivers for their http://downtownsault.org/alberta-house/ free viagra without prescription license, a driver’s education school also helps students become safe and responsible drivers.

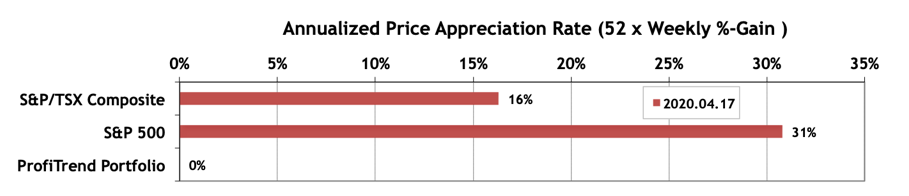

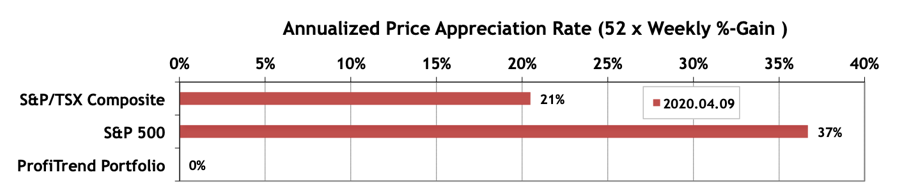

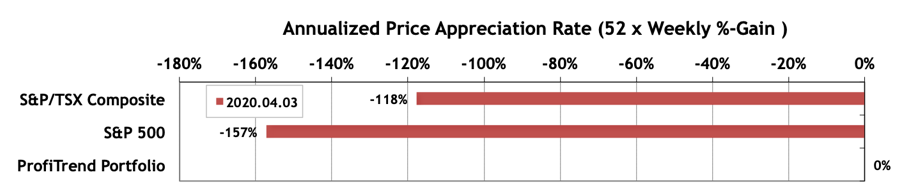

PTP… You can see that we’re still 100% in cash. We’re not avoiding volatility (which we welcome). We’re avoiding too many kinds of risk. The S&P/TSX Composite Index APAR lost 3 points, while the S&P 500 APAR pulled back 21.

PTA Perspective… Profiting from Free Oil!

Last Monday, West Texas Intermediate Crude Oil dropped to $0.00 per barrel. But it didn’t stop there! Before the session closed WTI was priced at -$37.63 per barrel. That’s what producers would have to pay someone to take it away. It didn’t stay there during the rest of the week, but we’re at a point of unbelievably low oil prices, as demand has dried up, and various OPEC & Friends countries are refusing to cut production. This week we bring you some thoughts on whether you can profit from this.