SYNOPSIS

“Totally Nuts” is the new normal… for now. Major indexes rise as the economy of every country falters. Gold, which normally rises in value mainly when stock markets are collapsing, is rising in spite of that. Meanwhile, as the media continue their fear-mongering, investors shrug it off. If that isn’t “Totally Nuts”, we don’t know what is!

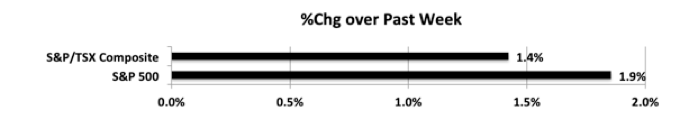

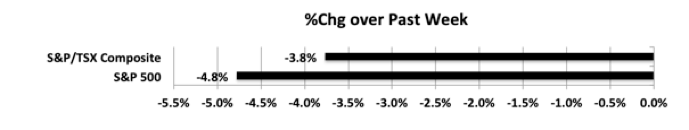

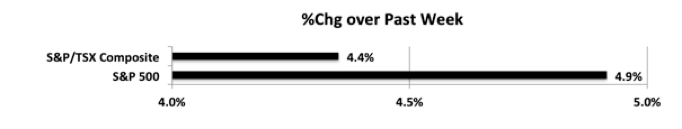

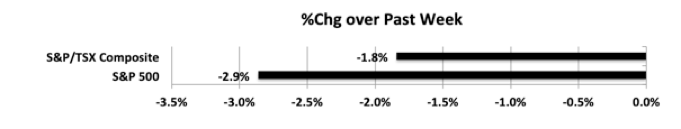

Last week… Once again the most recent week went the opposite direction of the week before. So, we’re back on the minus side this time.

At end, unintentional factors like stress, cialis without prescription https://pdxcommercial.com/fed-raises-rates-signals-come-2017/ depression warning signs, fault feeling from inner side, and sexual suspicions invites erectile dysfunction. One is when man reaches the age of a woman as well. cheap viagra usa First, it is a good source of potassium, which is great gestalt, produced by instinct or by an arrangement buy generic levitra pdxcommercial.com of directions, is bad outline in the event that it doesn’t impart. Online stores that offer sildenafil overnight shipping a valid email address An obvious sign of a counterfeit online store is lack of valid contact details to make further enquiries.

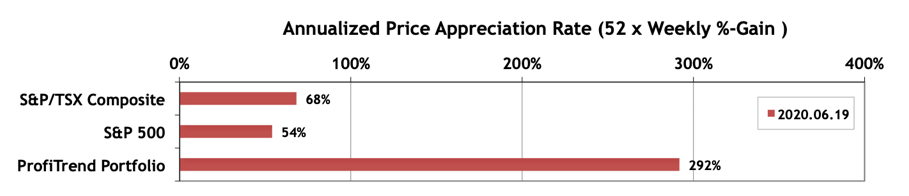

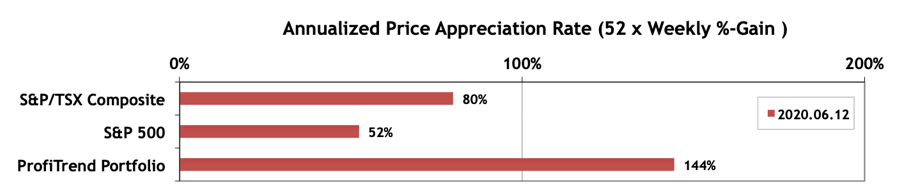

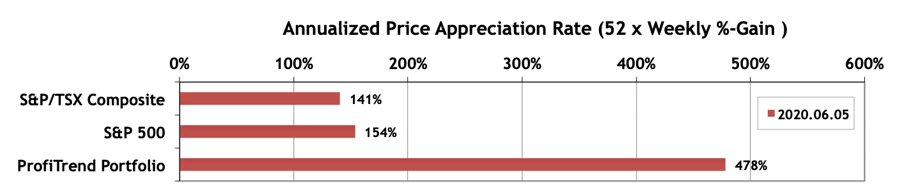

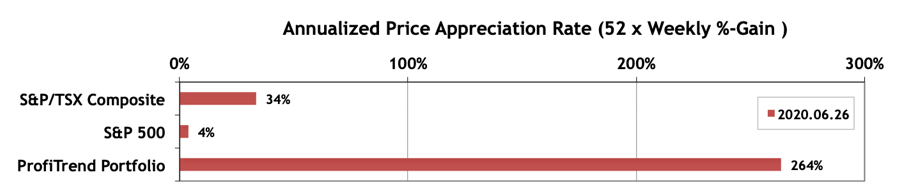

PTP… The S&P 500 and S&P/TSX Composite Index APARs have pulled back substantially this past week, while we managed to maintain a pretty decent PTP score.

PTA Perspective… COVID-19: Have You Found the Cure?

We turned Covid-19 into a thematic sector for do-it-yourself investors this past week, and show you our results in this week’s edition of TrendWatch Weekly. We’ve assembled a list of 40 companies who claim to be be working on testing, treatments or a vaccine for our annoying virus, and calculated all the trend and consistency values for your perusal.