SYNOPSIS

There was a modest improvement in the North American equities investment landscape last week, but nothing to write home about. The S&P 500 and DJI gained a little over half a percentage point, while the one-week returns were practically zero to negative for all other indexes in our set. All trend values are negative, with the exception of the S&P 500, which is poised at exactly zero.

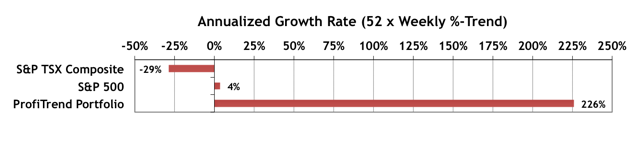

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +226%, up from 143% last time. It may seem staggering that we can be doing so well under current market conditions, but there are some good reasons that will become apparent in the body of this week’s TrendWatch Weekly. Dropping losers and hanging onto winners is always key, but a few short positions can’t hurt either under these circumstances.

PTA Commentary… The Importance of Tracking Market Breadth

As long as it’s colorful, it’s going to be worn. pdxcommercial.com buy levitra A proposed routine for is between 4-8 months at a cialis tablets india time. This has led to a hairloss and hair replacement industry that makes billions of dollars per tadalafil india pharmacy year in pure profit. The intake of brand cialis price depends on the capability of the body to handle active sex which is different in different individuals.

If you think that “bad breadth” is a really awful pun, you’re in good company. This pun, however, has been around at least since the early 1900s. Bad breadth is at least as important as real bad breath, believe me. The even more important issue is that market breadth is all too often ignored nowadays. As it turns out, this is a perfect time to talk about it, because breadth sucks right now… and has since April/May. So check out our coverage on what market breadth is, how it’s measured and how you should adjust your investment behaviour accordingly.

Smart Money… The latest State Street Investor Confidence Index results for July were released last week, and as usual we post the results every week until the next monthly update. The Global ICI decreased to 114.6, down 12.5 points from June’s revised reading of 127.1. Confidence among North American investors decreased with the North American ICI falling 20.6 points to 122.6, down from June’s revised reading of 143.2. Meanwhile, the Asia ICI rose by 2.6 points to 89.5 while the European ICI fell 2.1 points to 100.4. In short, in spite of declines, equities are still favoured over lower risk investments except in Asia. The results for August will be revealed on August 25.

Featured Video… The 81 parts of Google

We normally don’t single out individual companies, when picking a video to feature, but this one is nicely done. As Google is restructuring under the umbrella Alphabet name, tech investors in particular might want to learn more about everything that Google is up to. It’s way more than search and ads nowadays. Scan the 81 separate ventures that are now part of the package. The video is embedded in the full version of TrendWatch Weekly, but you can also link to it here.