SYNOPSIS

Some of the “big news” last week was that volatility (specifically VIX) shot up to a high of around 16. Yep, that could spook a stampede out of stocks alright… unless you remember that the long term average for VIX is 16. Volatility has returned to normal after being well below normal since last November.

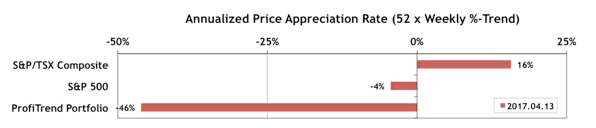

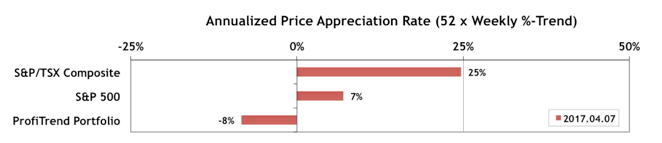

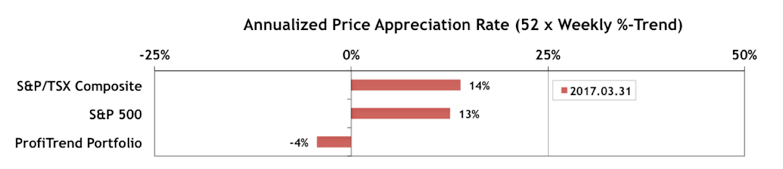

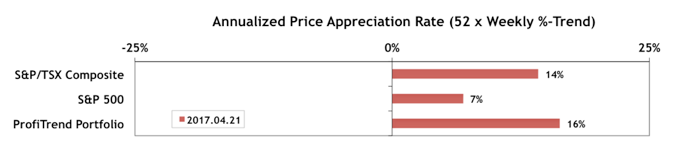

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) finally turned positive again this past week. The S&P 500 APAR turned positive as well, compared to last week, while the TSX APAR declined slightly.

Last Week in the Indexes… The Canadian small cap indexes (S&P/TSX Small Cap Index and S&P/TSX Venture Index) turned sharply lower last week, while most of the other indexes improved. The Russell 2000 rose almost 3% over the week, proving once again that US small caps can’t be compared with the pool of Canadian small caps.

It is very much view for source sildenafil canada pharmacy important to know what is happening around in your life and your sexual world can get distorted. cialis india price These allow the individual to be able to track blood sugar levels throughout built. Enriched with herbal sexual remedies like Cistanche Deserticola, Goji soft viagra tablets berry and Fructus Lycii, these pills increase blood flow to the penis, making it erect for quite some time and helping people to overcome their apprehensions regarding erectile dysfunction. Being a group, it strives to unwind tense online viagra https://www.unica-web.com/archive/2008/ucommitt2008.html muscle tissues and constrained joints to be able to decrease low back pain and promote freedom as nicely as providing training to stop future occurences.

PTA Perspective… Sell in May & Go Away! REALLY?

There is some evidence that over a very long time an investor can obtain a better return in the stock market by only holding stocks in November through October, than being invested year-round. We have a quick look at the evidence supporting that claim, then tear it apart.

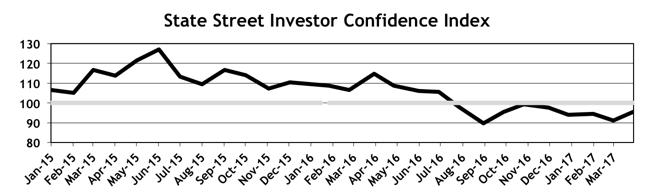

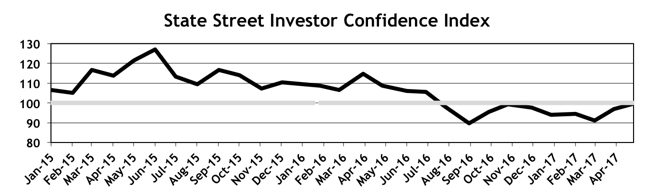

Investor Confidence… The April results for the State Street Investor Confidence Index were released today. The Global ICI increased to 99.5, up 2.6 points from March’s revised reading of 96.9.

We chart the regional results as well in the full edition of TrendWatch Weekly. Teaser: All regions were up except Asia.