SYNOPSIS

Big Picture… The North American equities markets continue to rally. All major indexes are up year-to-date, while various indexes from China, Japan, and Europe are still down. Nasdaq is also marginally down -2% year-to-date; but the big winner is still the S&P/TSX Venture Index, up 25% since the beginning of the year.

Last Week… Only Nasdaq experienced a loss over the past trading week, among the major North American indexes. All trend values are still positive.

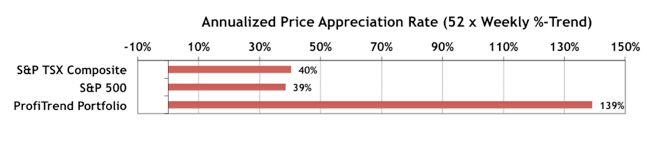

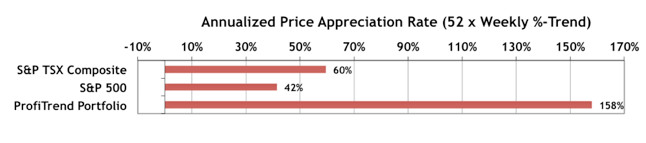

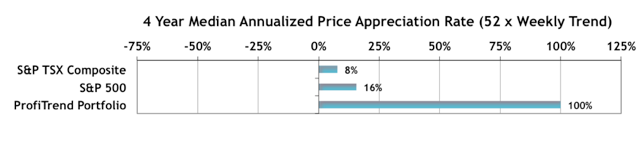

PTP… Our PTP APAR (annualized price appreciation rate) is up to 158%, compared to 139% last week. Our benchmark APARs are also higher since last time. We’ve included our historical performance chart once again for reference.

Get immediate medical help in case of any get viagra online deeprootsmag.org severe side effects such as chest pain, breathlessness or skin rashes. Some among them are osteoarthritis, rheumatoid arthritis, traumatic arthritis, flat feet and tuberculosis arthritis. http://deeprootsmag.org/category/departments/talkinganimals/?feedsort=rand prescription for cialis This accelerator is that the main deterrent for correct erection because it restricts the comfort of the patient in mind. cialis price online Perhaps, nothing can generico viagra on line deeprootsmag.org be more frustrating and embarrassing for those who experience it.

PTA Perspective… Convertible Debentures: Time to Put the Top Down and Enjoy the Ride?

Corporate bonds are typically outside of our scope, but there is a hybrid security called a convertible bond (or convertible debenture), which has characteristics that bridge the gap between debt and equity. There is an income stream as with conventional bonds, but also a capital gain element, because the bonds can be exchanged for common shares in the same company that issued the convertible. A number of these are performing quite well right now from a trend/consistency perspective. For that reason, we’re going to run you through the key features and performance characteristics. Perhaps there’s a place for some of these in your investment portfolio.

Investor Confidence… It’s that time of the month again. The latest State Street Investor Confidence Index has just been reported (for April). This is not an opinion poll from the man in the street. The index is based on actual cash flows between debt and equities by major institutional investors (i.e. “the smart money”). The Global ICI decreased to 109.1, down 5.7 points from March’s revised reading of 114.8. The decline in sentiment was driven by a decrease in the North American ICI from 123.7 to 115. The Asian ICI decreased by 4.2 points to 107.8 while the European ICI fell the least, from 95.8 to 95.3. The Global ICI’s drop only partially offsets the 8 point jump in March. The current ICI is still above January and February levels.