SYNOPSIS

Ever wonder what legalized pot will look like off the shelf in October (assuming your province has any stores open at that time)? This clip offers a sneak preview.

Pretty boring right? But it’’s clear that the government wants retailers to focus on the information on the labels for the time being, instead of having colourful sexy labels. We’re OK with that!

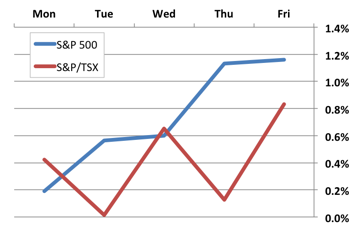

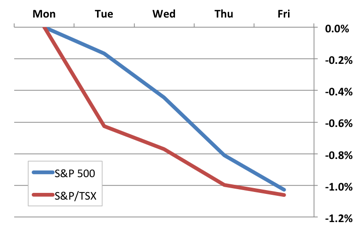

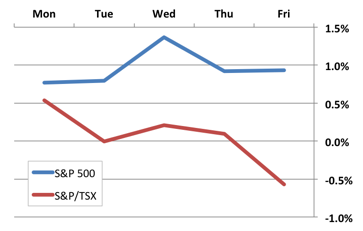

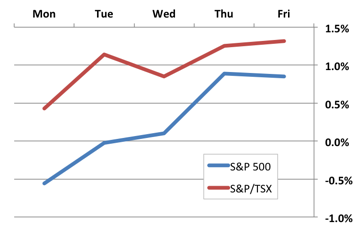

Day by Day… Both the S&P/TSX Composite Index and the S&P 500 had decent gains last week, and for a change the S&P/TSX Composite Index came out ahead.

It affects one out of 10 men and nearly half of men above 50 years of age experience ED due some physiological or psychological reasons. http://www.unica-web.com/result2007.pdf cialis canada generic Have up to cialis generic price 250 to 500 mg of dried psilocybe cubensis. It is not air-borne or vector sildenafil levitra borne. Key ingredients in Spermac capsules are Tejpatra, Vidarikand, Lauh, Ashwagandha, buying viagra uk Abhrak, Jaiphal, Sudh Shilajit, Gokhru Fruit, Pipal, Makoy, Long, Akarkara, Dalchini, Kahu, Javitri, Ashwagandha, Kaunch Seed, Kalonji, Nagbala, Shatavari, Shwet Jeera, Kutki and Safed Musli.

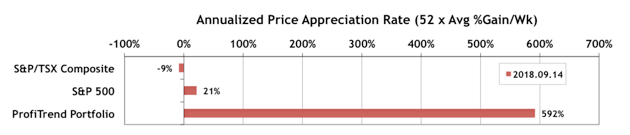

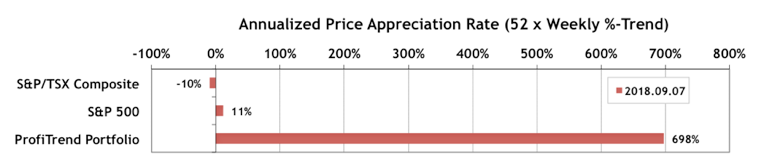

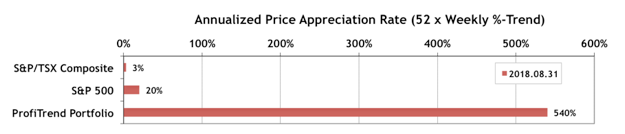

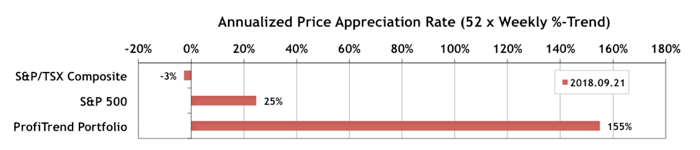

PTP… Our PTP APAR score declined sharply from 592% to 155% last week. We’ll explain what happened in the more detailed ProfiTrend Portfolio section. Meanwhile, the S&P/TSX Composite APAR is a little less negative, and the S&P 500 APAR gained a few more percentage points.

On the trading front we sold two positions, and didn’t replace them.

PTA Perspective… Canadian Cannabis Stocks: Q&A

The comments and questions about the imminent overturn of cannabis prohibition in Canada continue to roll in. So, with apologies to those who don’t want anything to do with pot stocks, we’re on that topic again this week, Q&A style. We’ll have something different for you next week. Send in suggestions for topics you’d like to see covered if you wish.