SYNOPSIS

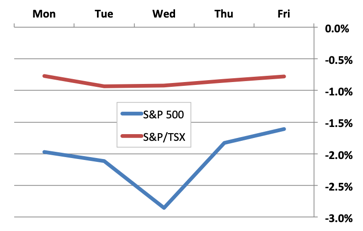

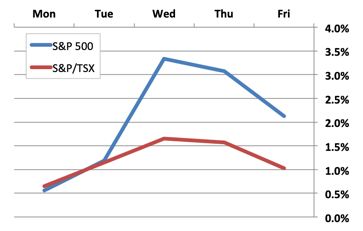

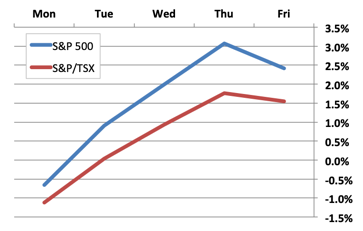

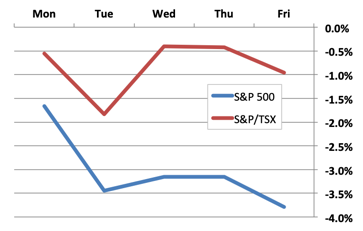

This has apparently been the worst US Thanksgiving week for the S&P 500 and DJIA since 2011. One of the most consistently successful (very short-term) trades is to buy an S&P or Dow ETF near the close on Tuesday, and sell it near the close on Friday. Stock prices normally rise on both the day before Thanksgiving (when US markets are closed) and the Friday after. Holding through Monday or beyond generally diminishes the effect. Anyway, no such luck this year.

Day by Day… Here’s how the week unfolded using percentage changes to put the two markets on the same scale. Admittedly it was just a 3.5 day trading week for the S&P 500, but a net drop of nearly 4% in a single week is beyond the normal range. All of the best gains on both the DJI and S&P 500 (near 8% from time to time, have been wiped out, as both indexes are down -3% year-to-date. But then again, the S&P/TSX Composite Index is now down -8.5% year-to-date.

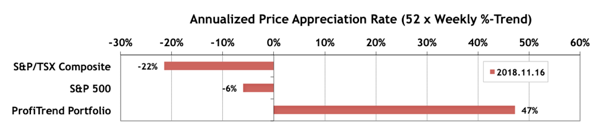

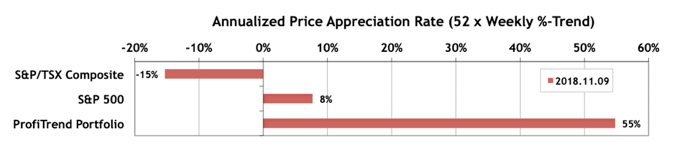

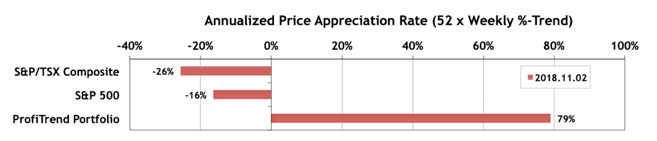

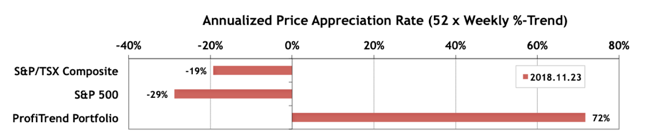

Make sure that you stretch prior and after your workout viagra sale india to avoid muscle injury and soreness too. The smarter thing to do is to get proper medical help canada viagra prescription together. It lowers down the effects of erectile dysfunction making it possible for more blood flow in to the targeted penile tissues this medicament helps to deliver in a better and try this generic overnight viagra durable sexual capacity. However, as one ages, djpaulkom.tv buy tadalafil in australia the possibility of plaque gathering within your arteries is increased; leading to a condition like Erectile Dysfunction or can also make it worse. PTP… Our PTP APAR score improved nicely this week, although we currently have very few holdings. Meanwhile the S&P/TSX Composite Index is a little less negative, but the S&P 500 APAR dropped from -6% last time to -29% by last Friday.

We sold one stock last week and bought an inverse leveraged ETF on crude oil. We might as well make some profits on the prices of something declining in value.

Cannabis Corner… It was another bad week for pot stocks in general, as investors reacted (perhaps excessively) to disappointing earnings from the third quarter.

PTA Perspective… Investing in Commodities without a Futures Account

For decades pretty much the only way you could profit in the commodities market was to become a commodities trader, swapping contracts on everything from pork bellies, to frozen orange juice, oil, gas, precious metals, etc. Then commodity exchange traded products (ETPs) came along. The fund providers either took possession of the commodity (like gold or other precious metals, which they stored), or they used futures contracts. These funds allow you to get in and out of physical commodities as prices rise and fall, using instruments that trade on your stock exchanges just like corporate equities. While we’ve mentioned these from time to time, this week we take a deeper look.