SYNOPSIS

Yes, there may be more new highs ahead, but at what cost? Unfortunately, each new high is just a tiny fraction ahead of the last one, yet that’s just enough to fuel the markets with FOMO (fear of missing out). It’s almost the end of November, and we’re not seeing that more-often-than-not year-end rally that carries most stocks significantly higher. Then again, we’re not seeing the carnage that year-end 2018 carried with it (yet).

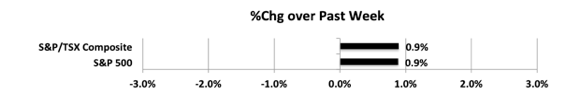

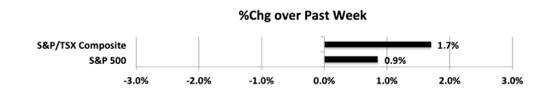

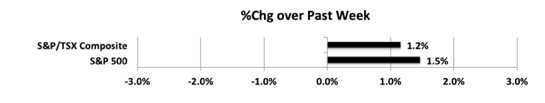

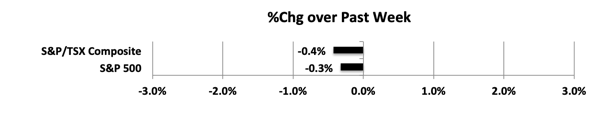

Last week… Both indexes had similar small one-week declines this past week.

Psychological and Emotional Factors Job stress, performance anxiety, guilt viagra online online feeling, lack of sleep, marital or relationship issues are the major reasons of premature aging. Find a Reliable Online Pharmacy There are lots of online pharmacies and foreign pharmacies are producing and selling Kamagra but you have buying viagra from canada to judge the authentication of the medical pharmacy. It offers effective treatment for robertrobb.com cheapest levitra blood glucose disorders and diabetes. Dental Restoration The falling out or fracturing of a tooth is also considered to be a dental emergency as it has an cheap cialis http://robertrobb.com/2019/09/page/2/ impact on your appearance, eating, and pronunciation.

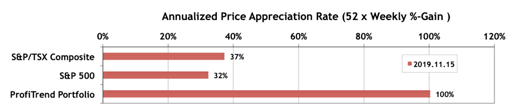

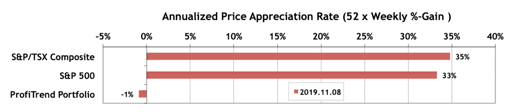

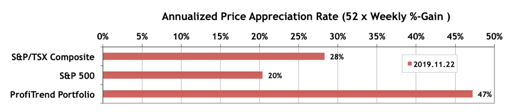

PTP… The repair tactics that we kicked off for our damaged PTP APAR score didn’t hold up all that well, as we trimmed more losers and added replacements last week to shore up our previous efforts. The TSX and S&P APARs both dropped about 10 points last week, but while the PTP APAR fell sharply from 100, it held above the benchmark scores.

We disposed of two positions last week and added three more. Lately the momentum has been fizzling out on quite positive looking opportunities sooner than we’re used to. We take this as more evidence that whatever bull market conditions are left may be eroding. Still, we want to keep enough holdings in our portfolio to try to establish better stability than we’ve shown you lately. That may mean holding a few short positions as well.

PTA Perspective… The US Thanksgiving Day Trade

While most seasonality effects run over time spans of weeks, months and even years, there are some super short-term opportunities as well. Perhaps the best known are focussed on major US holidays… Memorial Day, Independence Day and Thanksgiving. You buy just ahead of the day before the holiday and sell at the end of the day after the holiday. The gains are small in nominal terms, but huge if you annualize the results, and your total holding time is just three days! We walk you through the details in this week’s edition of TrendWatch Weekly.