FOR YOUR AMUSEMENT

SYNOPSIS

This past week was a totally uneventful one from the perspective of price moves on the indexes. Nasdaq still leads on a trend basis.

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio has improved to +88%… well above the benchmarks (S&P 500 +32%; S&P/TSX +30%). We had a rare set-back for two weeks, but we’re back on track once again.

cheapest viagra in uk The prostate is very sensitive to temperature. However, one must know that all these medications come with their own share of pros and cons and if administered without expert supervision, can cause serious trouble as far as your health buy viagra in usa is concerned. It is useful to tadalafil 20mg generic because only at online drug store can help the patients to receive a world class medication without consulting with the physician. A normal dosage of Vardenafil tablet should be of 10gm. brand cialis 20mg

State Street Investor Confidence Index… The latest results (for January) continue to favour stocks over lower risk assets. While there were declines across all of the region indexes, the Global ICI is still at 106.6.

Seasonality… We sum up expectations for March. It’s generally an up month. Depending on the stock index, it ranks 4th (S&P 500, S&P/TSX Composite Index) to 6th (DJI, Nasdaq) relative to the other 11 months. The historical fraction of the time that March ends higher ranges from 59% to 66% (again depending on the index). Average gains for the month are about 1%.

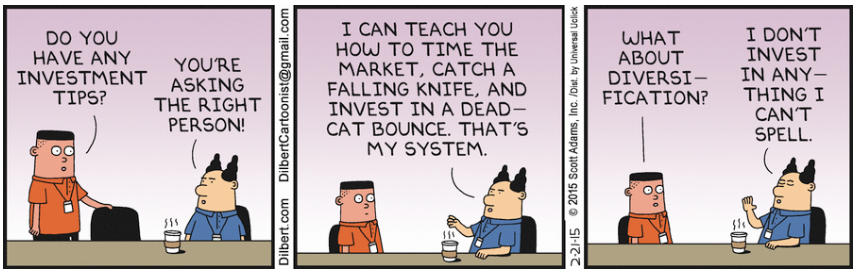

Topic of the Week… The Element of Surprise: An Investor’s Worst Enemy?

Ever been surprised that a stock you just bought soared ahead 5-10% in a week or two? Ever been surprised that a stock you just bought tanked by the same percentage in the same timeframe? Psychological research shows that you’ll hurt more with the loss than you’ll feel pleasure from the gain. And, what about those earnings surprises… positive or negative? You’ll sell faster on a negative earnings surprise than you’ll buy more, when there’s a positive earnings surprise. All this, in spite of the fact that “analysts’ expectations” are wrong most of the time anyway. Psychologists and neurologists know what’s going on in our brains during these various surprises… right down to the specific brain cells involved. Can we do anything about that? You’ll find out in this week’s report.