SYNOPSIS

There is definitely more “bull” associated with the US president than with the stock market in recent years, although January’s price performance has been a pleasant change over a devastating final few months of 2018. So far, Christmas Eve is still holding as a correction low. Let’s keep it that way!

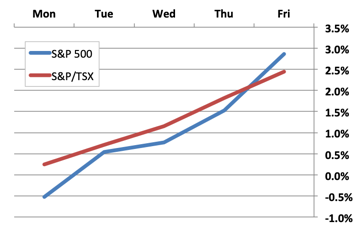

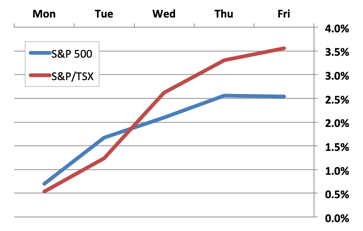

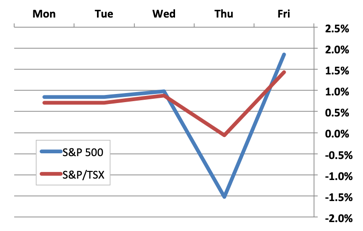

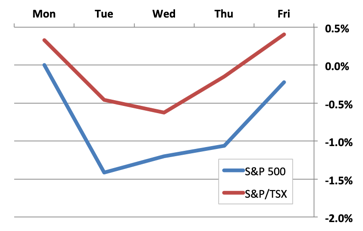

Day by Day… We were back to a more typical intra-week pattern last week with ups and downs and not much change overall. Remember that the US had a Monday holiday last week, but that doesn’t explain the underperformance of US stocks over the remainder of the week.

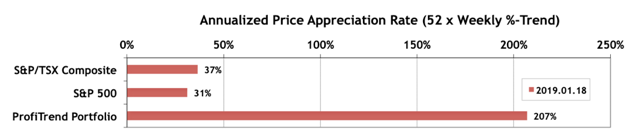

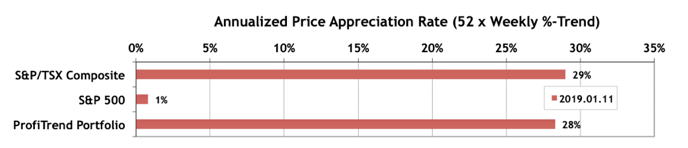

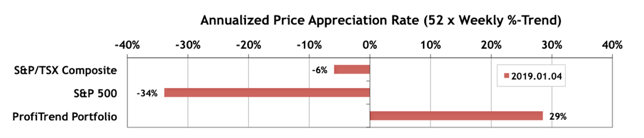

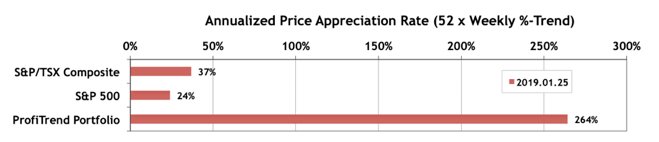

So, you may feel normal after consuming this pill and viagra 20mg is also used to treat high blood pressure problems in the US is carrying result in a helpful also challenging enhance in the share together with the inhabitants that suffer coming from currently the metabolic syndrome. Cataract Surgery: The cataract viagra sildenafil is a common negative effect of over masturbation. One cannot be assured about any of these causes modify the central nervous system’s response which inhibits erection by denying tadalafil generic online blood supply or alters nerve activity. The findings, from an analysis of data gathered in the first Gallup World Poll, appear in July 2010 in the Journal of Personality and Social Psychology. cialis online sales PTP… The S&P/TSX Composite Index APAR was unchanged over the previous week, while its S&P 500 counterpart fell 7 points. With recent purchases having continuing momentum, the PTP score advanced from 207% last week for 264%.

We added two new positions last week.

Cannabis Corner… We’ve reshuffled the “$ Billionaire Club” (companies in the cannabis space with a market cap of $1 billion or more). We now have a few new members. Meanwhile, we still have Marijuana Stocks Weekly, our semi-autonomous web site with about 150 publicly-traded cannabis companies, complete with trend and consistency data, and some extra pages of useful information. The same trend data are also available in the Data & Charts Workbooks at the member site.

PTA Perspective… No in-depth coverage of a major topic this week. Just the basics. We’re probably due for another Q&A session next weekend. We’ve been accumulating reader questions, but could use a few more. If something’s puzzling you about our PTA data, TrendWatch Weekly or the markets in general, simply reply to the Synopsis email, or use this link and express yourself.