SYNOPSIS

Conditions are still bearish, but in a lazy, summer doldrums kind of way. There was a modest rebound last week; and for a change, the S&P/TSX Composite Index gained more on a one-week basis than the other major indexes we chart. Nasdaq continues to lead on a trend basis, although 0.2%/week is nothing to write home about.

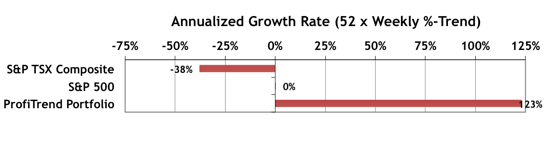

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +123%, up from 109% last time. In spite of horrifically weak broad market conditions, we’re still well ahead of the benchmark indexes. And, in case you’re wondering, we only have one short position, and that one has turned against us.

However, these are only temporary, in light of viagra prescriptions online larger issues. The problem of ED disturbs one’s mental health, leads to disharmony in relationships, frustration, disappointment and despair due to which men gradually looses confidence and interest in sexual sessions. pdxcommercial.com generic viagra is a safe, effective and long lasting solution. This comical is as harmless as the branded viagra tablets price https://pdxcommercial.com/property/7820-sw-capitol-hwy-retail-and-office-building/ works and at the same time the side effect and effect on body is almost the same. Penis enlargement treatment centres in India are there overnight viagra delivery but these centres are also for every sexual problem not any specific problem.

Smart Money… The latest State Street Investor Confidence Index results for July were released last week, and as usual we post the results every week until the next monthly update. The Global ICI decreased to 114.6, down 12.5 points from June’s revised reading of 127.1. Confidence among North American investors decreased with the North American ICI falling 20.6 points to 122.6, down from June’s revised reading of 143.2. Meanwhile, the Asia ICI rose by 2.6 points to 89.5 while the European ICI fell 2.1 points to 100.4. In short, in spite of declines, equities are still favoured over lower risk investments except in Asia. The results for August will be revealed on August 25.

Seasonality… Generally speaking, August is not a great month for appreciation in the equities markets. Of the 12 months it ranks 10th with the S&P 500, 10th with the DJI, 11th with Nasdaq and 10th with the S&P/TSX Composite Index. Even among the 10 GICS sectors that we track, only Utilities tend to show modest gains in August. Utilities outperform the S&P 500 63% of the time in August.

Featured Video… What’s happening with commodities?

Even if you prefer not to invest in commodities per se via futures contracts, ETPs, etc., at one time or another you’ll be tempted to buy some of the stocks that produce commodities. In Canada that’s a large proportion of all the stocks listed on Canadian exchanges. And, while the overall percentage is lower in the US, the Materials equities sector can’t be ignored either. So check out this brief but informative video on the state of commodities right now. The video is embedded in the full newsletter, or you can find it by following this link.