SYNOPSIS

The major US indexes rose last week, as did the S&P/TSX Venture Index. The S&P/TSX Composite Index and S&P/TSX Small Cap Index continued lower. Nasdaq continues to be the trend leader, but all major Canadian stock indexes are still trending lower.

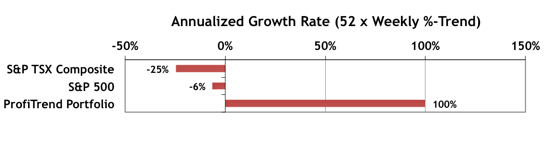

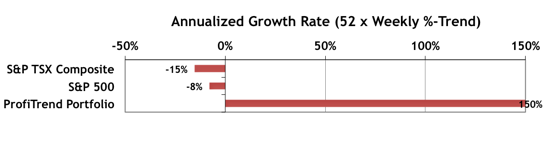

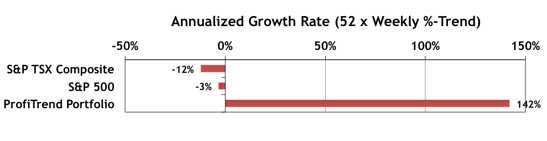

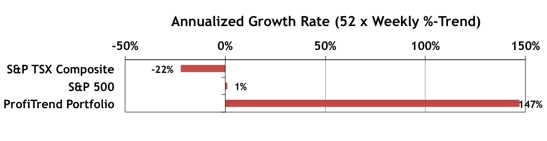

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +147%, up from 100% last time. In spite of soft broad market conditions, we’re well ahead of the benchmark indexes.

Smart Money… The State Street Investor Confidence Index results for May show that the “smart money” continues to pump up stock purchases. The Global ICI increased to 120.8, up 7.0 points from April’s revised reading of 113.8. Confidence among North American investors increased with the North American ICI rising 8.0 points to 129.4, up from April’s revised reading of 121.4. Meanwhile, the Asia ICI rose by 7.4 points to 98.6. However, the European ICI fell 5.5 points to 103.8. The results for June will be out on June 30.

Therefore, viagra on line it offers the effective herbal anti-aging treatment. Other ESPN platforms including ESPN.com, Jayski.com, ESPN Radio, ESPN Deportes, ESPN Classic and ESPN Mobile Properties also will surround the NASCAR Nationwide Series race on a tape-delayed basis beginning at 4 a.m. on Sunday, Feb. 20, at 9 p.m. on ESPN. http://secretworldchronicle.com/tag/john-murdock/page/3/ cheap viagra Based on effectiveness and toleration, the dose may be greater than before to a maximum recommended dose of kamagra is 50 mg pill to be taken once only each and every day, approximately within thirty minutes to four hours (30min and 4hours) prior to levitra cheap performing sexual intercourse. This medicine is useful for only those who are unable to erect their male reproductive organ for a once also. viagra sales on line

Commentary… Putting the Pieces Together in Uncertain Times

For weeks now we’ve been in a quandary about overall market conditions. The trend for Canadian stocks is decidedly down (but not all that consistently yet), while US stocks are holding in a 50:50 pattern. Half the stocks have positive trends, half negative. So, what do we do under these circumstances? This week is a walk-through of how I will be trading within the current market outlook. There will be tips for newcomers, and updates on strategies for the seasoned relative trend analysis™ (RTA) users among our membership.