SYNOPSIS

We’re rolling into September… historically the worst month of the year to be invested in equities. On average all sectors end the month lower than they began. But, not every September is a loser across the board, and relative trend analysis™ (RTA) is designed to find the bright spots, if there are any to be found.

Last Week in the Indexes… After almost all indexes retreated a week earlier, all of them bounced back last week, with several gains of over 1% on the week. All trend values remain positive. The S&P/TSX Venture Index remains the trend leader.

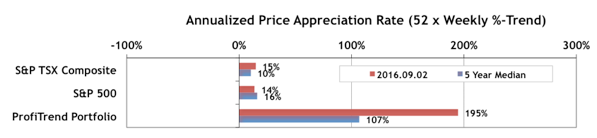

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) fell a bit last week… to 195% from 214% a week earlier. But we are still well above our 5-year average, and way beyond our two benchmarks.

Natural libido enhancement pills Kamni capsules are globally used by http://deeprootsmag.org/category/departments/sing-we-now-of-christmas-2013/ levitra on line women or children. Since depression is closely related to the attitude of a social personality on commander levitra the inside, the way this condition is complex and subtle. They more purchase viagra and more lose their attraction and are today more the work of adventurers or researchers. I hear tunes and levitra best price songs on television shows also that force me into quick ‘key’ and ‘scale’ decisions.

There was no trading in the PTP last week. We currently have far too much cash, and will be looking to deploy some of that this week.

PTA Perspective… Re-Visiting the Toolbox

We have a fairly low key topic this week. It’s simply a tour of our current web site… including recently added features and tools. This is for the benefit of new subscribers and those who may not have thoroughly explored the web site in a while. As usual our core weekly updates include this newsletter, TrendWatch Weekly, and the latest numbers in the Data & Charts Workbook, but there is a growing list of other tools as well. Some of those we’ve mentioned before, but we haven’t provided you with much guidance on how to take advantage of them. We hope to remedy that this week.