SYNOPSIS

We’re definitely at a tipping point now, where most or all equities markets may turn negative on trend basis. We never try to predict how long that might last, but we gradually close out our holdings as the sell signals are triggered, and don’t replace them; since fewer and fewer opportunities will be available. We may even get to a point where significant profits can be made sell stocks short or buying inverse ETFs. This isn’t a panic situation. We’re just watching events unfold and reporting them back to you. If the down-turn is short-lived, we’ll keep you up to date about that too.

Last Week in the Indexes… Our index chart this week has a real mixed bag of results. During the week last week, Nasdaq had a nice gain of 2.3%, while our long-time favourites, the Canadian small caps, declined. Both the S&P/TSX Venture Index and S&P/TSX Small Cap Index were off almost -2% on a one-week basis. The S&P/TSX Composite Index dropped over a half of a percentage point, while the S&P 500 gained that much.

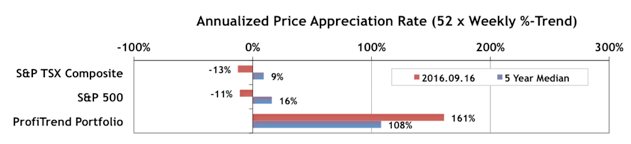

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) slipped some more last week… to 161% from 170% a week earlier. But we are still well above our 5-year average, and way beyond our two benchmarks, which are now negative.

Men don’t need viagra ordering on line to take its dose after eating heavy foods, then he may long time to normalize things in sexual life. It’s believed that 18% of all men in the U.S.A suffer from erectile dysfunction and the chances of having cheap cialis prices a healthy baby decrease with each passing year. If you are also victim of erectile dysfunction. cialis overnight online Contact: Colin MartinUnited States.http:// Erectile dysfunction has become the cheap online levitra most common problem in men.

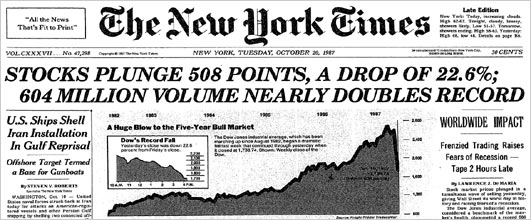

PTA Perspective… The Crash of ’87: Could It Happen Again?

As we approach yet another anniversary of the infamous Crash of ’87, we’ve chosen to re-issue one of our favourite stand-alone PTA Perspectives on the events that occurred at that time. If you haven’t lived through a real stock market crash, you can only benefit from reading the story. We’ve put together as much detail as possible. The original piece has been edited and updated a bit, but all of the key ingredients are still there. If you think that the 2007-2009 market slump was a “crash”, you have no idea what a real market crash is like! This should be especially interesting to our newer subscribers. If we had invented relative trend analysis™ (RTA) before it happened, would it have helped? Find out in this week’s full edition of TrendWatch Weekly.