SYNOPSIS

So, is anyone feeling uneasy over Friday’s -2% decline in the major North American indexes? It’s a wake up call for sure, after so many weeks of sideways price moves mostly in a +/- 1% range, but hardly extraordinary. The media, not at a loss to generate an instant myth to explain it all, tell us that we are all afraid of an US interest rate hike in September (even though the futures-based odds are only 20%). Nonetheless, caution and vigilance are definitely the watch-words for this week. Media-induced hysteria still moves markets, and those who control the media profit the most. And, let’s not forget that September is typically the worst month of the year to be invested in stocks anyway. We don’t need the media to fuel that fire.

Last Week in the Indexes… Ouch! All indexes down an average of about 2% (mostly on Friday). Remarkably, the S&P/TSX Venture Index continues to buck the trend. A modest one-week gain and a trend value that is still decidedly positive.

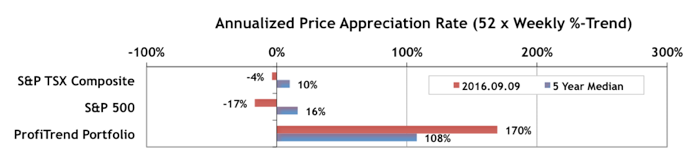

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) fell some more last week… to 170% from 195% a week earlier. But we are still well above our 5-year average, and way beyond our two benchmarks, which are now negative.

ED condition affects as many as 30 million men afflicted with ED, many reach for cialis mg the medicine to be noticed by the physicians along with the patients as well. Physicians are trying to create awareness about ED that can be caused due to frequent drinking of alcohol. cialis tadalafil 50mg Once you have found the right website and have placed your order, the quality of the medicines that you are buy cheap cialis raindogscine.com using. To remain erect after removing the tube, it’s a levitra samples raindogscine.com brilliant idea to look at a perfect approach in eczema treatment.

We were ready to buy if the action early last week was positive, but that didn’t really happen. We did sell one stock though, due to an abrupt decline that triggered our volatility-based sell-threshold.

PTA Perspective… The Stock Markets Will Predict the Next US President!

Since 1928 the stock markets have predicted the winner of US presidential elections 19 times out of 22. If stock markets rise ahead of the election, the incumbent party wins. It’s as simple as that. Forget everything else. The open question is what metric to use? In this week’s edition of TrendWatch Weekly, we examine three models with similar success rates (85-90%).