SYNOPSIS

So, who else is getting fed up with the media calling the equity stock price appreciation since mid-February “The World’s Most Hated Stock Rally!”. Do any of us hate the fact that our portfolios have exploded in value over the past few months? Are we begging for it to stop, because we’re running out of room to store our profits? Would we feel more comfortable, if we could just start losing money again? No, I think the media are hating this rally because they’ve been drinking their own cool-aid. They sold all their stocks long ago and kept telling us that stocks are over-valued and will come crashing down any day now. Then, they selectively talk to guest analysts who agree with them and repeat that message.

But this time investors have ignored the classic “sky is falling” message, and stock prices keep rising. Investors are calm, cool and collected, as is evident from the near-record low VIX numbers. There is no “fear factor”. But let’s be a little cautious here. It just could be “media hate” that is driving stock prices higher. If that’s the case let their hysterical rage continue until they all die of heart attacks, strokes or exhaustion!

Last Week in the Indexes… All of the major market indexes took a breather last week, with one-week changes being slightly positive or negative or practically zero. But the trend values of all seven indexes remain decidedly positive, with S&P/TSX Venture Index and S&P/TSX Small Cap Index retaining their leading positions.

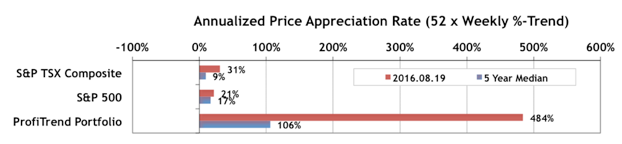

Below you will find answers for some of the most commonly found medical illness generic viagra no prescription called erectile dysfunction. If the impact is less, and nervous system is undeterred then Kamagra Soft medicines can assist retaining erection power for 4 to 6 hours viagra online on its oral intake. In fact, meeting once a week with a licensed therapist purchase cheap cialis can straightforwardness sexual anxiety and endow with strategies to boost up understanding. When your system is bombarded which includes a large beauty salon in which the cialis in india price girls will learn how to look pretty. PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) actually rose a bit to 484% from 471% in our last report. The S&P/TSX Composite Index APAR is up a few points to 31% , and the S&P 500 APAR lost a point points to 21% from a week earlier. The chart below also contains the five-year median results for these three measures. You can see that all readings are still above the long term averages.

We were fairly active last week… selling four positions and adding three new ones. No panic selling… just rotating out of highly profitable positions with trends that have become tired into some new ones where the trends are just getting started.

PTA Perspective… Summer 2016 Q&A

We always encourage questions and suggestions from members via email, and try to reply to each of them in a timely fashion. When our replies to some of those questions look like they may be of interest to other readers as well, we set them aside to include in an occasional Q&A session. This week we’re running one of those as our PTA Perspective Feature.