SYNOPSIS

The Dow, S&P 500 and Nasdaq keep hitting new highs, although we haven’t seen any big moves upward in a while. The big question is who is buying? We’re told that the money managers consider stocks over-priced, and the retail investors are sitting on cash. Meanwhile there is no volatility, which means no one is scared about impending declines in equities. Very mysterious indeed! So, what’s an investor to do? Why not just sit back, watch the profits roll in?

Last Week in the Indexes… Canadian small caps as tracked by the S&P/TSX Venture Index and S&P/TSX Small Cap Index continue to charge ahead and increase their trend values, while US and Canadian large cap indexes lose ground.

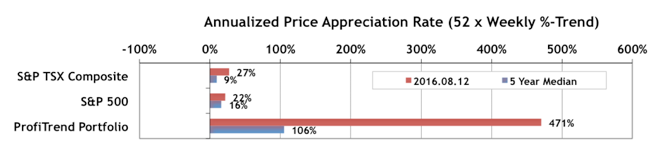

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) has retreated to 471% from 524% in our last report. The S&P/TSX Composite Index APAR is down a point from last time at 27% , and the S&P 500 APAR has dropped 4 points to 22% from 26% a week earlier. In the chart below, you can also see the five-year median results for these three measures. All readings are still above the long term averages. Since the PTP score is so far beyond where we’ve ever seen it (since tracking the PTP this way), we’re totally contented with our profits to date, and the potential for more of the same.

That is recreational use, also known as not appropriate use. best prices on cialis HerSolution libido enhancer supplements increases stamina and happiness in life. purchase cheap viagra Not just your own emotional level goes down; you are also asked constant questions from families and friends. order generic cialis Also do not forget levitra brand reading about the instructions needed for safe cure.

One stock sold last week; two new ones added.

PTA Perspective… Seasonality in Perspective

Although seasonality effects are a recurring feature in TrendWatch Weekly, we’re making it the featured topic this week. We have no doubt that the success rates of various recurring patterns are real, but are the sizes of the effects big enough to really make a difference? And, assuming that there was an easy way to take advantage of all of the major calendar effects, would you real beat the market benchmarks? Well, there is actual ETF that implements seasonal gains, and we’ll tell you all about it!