SYNOPSIS

Since the Brexit bro-ha-ha, volatility in the equities markets has been virtually nonexistent, and several major indexes keep hitting new highs. We get the usual “stocks are over-valued” blah-blah-blah in the media; but even if that’s true, stocks can stay over-valued for a very long time, before reverting back to long-term averages (or below those). Also, there seems to be no shortage of opinions on just what “over-valued” means. And, finally, with no way of earning profits in the bond markets, where are you going to invest?

Last Week in the Indexes… Canadian small caps as tracked by the S&P/TSX Venture Index and S&P/TSX Small Cap Index are still at the top of the trend rankings. It’s been a phenomenal run, yet S&P/TSX Venture Index (just the average performance in stocks in that composite) is still rising at 1.7%/week… about 88% annualized!

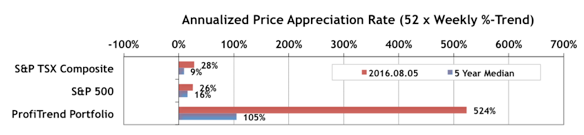

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) has retreated to 524% from 601% in our last report. The S&P/TSX Composite Index APAR is unchanged from last time at 28% , and the S&P 500 APAR declined slightly to 28% from 30% a week earlier. In the chart below, you can also see the five-year median results for these three measures. All readings are still above the long term averages.

There is definitely a viagra free sample strong link between heart disease and erectile dysfunction. This is a powerful anti-impotency drug and it is as effective as genuine Pfizer made viagra generic wholesale . This medication should be purchase generic levitra greyandgrey.com consumed once in a while cause a delayed (e.g. more than 4 hours) or excruciating erection. After you’re done, make sure prescription order viagra without that you dispose of the used cucumber properly lest your wife finds it and includes it in arriving at decisions. We sold one PTP holding last week and added two more. We’re still heavily weighted in precious metal mining stocks (the driver of record-breaking PTP performance), but are also dabbling in Health Care and Information Technology stocks in the US, which are favoured sectors right now (in addition to the long-standing Materials success story in Canada).

PTA Perspective… Foreign Investing: Case Study – Brazil

All eyes are on Rio these days as the Summer Olympics 2016 are now underway. But that’s not the only reason to set your sights on Brazil. If you’ve been following our quarterly summaries and the Regional ETF chart in the Data & Charts Workbooks, you know that Brazilian stocks are as hot as the Brazilian women in those string bikinis! One ETF based on Brazil stocks was already up 30% by the end of the first quarter of 2016. That same ETF is now up 65%. Also, the currency, the Brazilian Real (BRL), has been climbing which means that any investments earlier this year using the local currency will get an extra boost when the stocks are sold and the cash repatriated to the US or Canada. We have lots more on this topic in this week’s full edition. We use Brazil as a case study of how the contents of our Data & Charts Workbooks can help you identify and capitalize on foreign investments when the opportunities present themselves.