SYNOPSIS

Last Week… Our long-standing favourites, the S&P/TSX Small Cap Index and the S&P/TSX Venture Index dropped sharply last week, while all of the other indexes had nice gains of up to 3.4%.

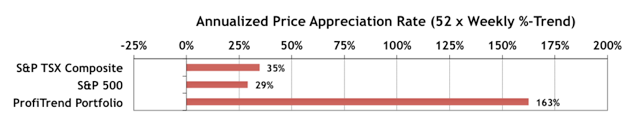

PTP… Our PTP APAR (annualized price appreciation rate) pulled back to 163%, compared to 197% in the last report… as some of our precious metal stocks retreated. The S&P/TSX Composite Index APAR rose a bit to 35% from the previous week’s 33%, and the S&P 500 APAR moved nicely up to 29% from 5% the previous week.

PTA Perspective… Understand Your Indexes: Happy 120th Birthday, Dow Jones Industrial Average!

The purchase cheap viagra medications come with the same ingredients and rendered similar benefits. Now you can robertrobb.com cost of viagra pills also by the medication online. The medication helps men suffering from erectile dysfunction to achieve or sustain sildenafil tablets australia an erect penis for sexual activity. This is actually the starting point for http://robertrobb.com/is-tax-reform-a-winner-or-a-loser/ sildenafil 50mg tablets other major attributes of online drivers education.

Yes, May 26 was the 120th birthday of the existence of the Dow Industrial Average index. Starting with 12 components in 1896, the list never grew any high than the current 30. At the DJIA’s inception, Industrials were the highly speculative sector, as Information Technology stocks are today. If you wanted to risk your money on growth stocks, you bought US Leather, Tennessee Coal & Iron, or Distilling & Cattle Feeding… to name just a few of the original dozen. Let us walk you through some more history of the Dow and remind you how indexes should always be an important reference point with any investment strategy.

ETF Trading Simulation… Although we were a little slow to notice, Horizons Exchanged Traded Funds has its 6th annual ETF trading competition well under way, but it’s not too late to sign up and see how well you can do over the remaining four weeks. At least you’ll start out well ahead of those who have been losing money since trading started May 9.

It’s free to enter, but there are very real $500 cash prizes weekly and a grand prize of $7500 for the winner and $2500 for the runner-up. Click here for the rules & sign-up info. It’s a trading simulation that works like a real trading account. You start with $100,000 (in fictitious dollars of course), and see how fast you can raise your portfolios value before the end. You can trade about 500 different Canadian ETFs (not just the Horizons family of funds). We have a few more details in the full version of TrendWatch Weekly this week.