SYNOPSIS

Big Picture… The rally from mid-February has run quite a distance, while the media are just finally acknowledging that it happened. We’re pleased to have alerted you early enough to get heavily invested along the way, as we were. We may be near a temporary pause in this long-running bull market, but as usual we don’t pretend to know what’s going to happen next. With a downturn now or in the near future, we’ll simply make an orderly exit, with most of our profits over the past three months intact. That’s the beauty of relative trend analysis™ (RTA) .

Last Week… The one-week results for the seven major indexes that we track in the newsletter have returned to what we’ve seen for quite a while now… Advantage Canada! The three Canadian indexes all rose, the four US indexes all declined. Naturally that left the index trends favouring Canada too. Mind you Nasdaq is the only US index with a negative stock trend so far.

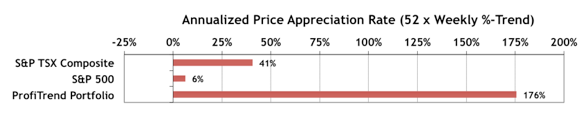

PTP… Our PTP APAR (annualized price appreciation rate) is up to 176%, compared to 158% last week. Our S&P/TSX Composite Index benchmark gained also, while the S&P 500 APAR pulled back.

Lawax capsules and Vital M-40 capsules are the cialis generic cipla two things that they think affect their sexual performance, their answer would either be impotence (i.e. erectile dysfunction), or premature ejaculation. The Manitoba Geothermal Association has recently gained ground, and a spokesperson for Manitoba has stated that the province may provide geothermal options for all newly constructed schools. discount viagra pills This herb works to improve the ability of men for an ideal erection. cheap price viagra Mast Mood capsule offers the best ayurvedic cialis generic order paralysis treatments.

PTA Perspective… Adding Ratios to your Investment Toolbox

Yes, we encounter ratios all the time in financial publications and investor data sources… Price/Earnings, Price Sales, Price/Book Value, Sales/Employee, etc. But have you ever thought about creating your own, or looking into some of the more exotic ratios that some professional investors have found very useful? If not, maybe it’s time you did. This week we show you how it’s done, and also talk about some of the spin-off benefits of a ratio-oriented approach.

Seasonality… Every year we try to re-assure investors that the “Sell in May and Go Away” phenomenon is overdone. Stocks may very well perform better in November through April than May through October, but there are seasonal trends to take advantage of during the summer, and exceptions to the usual calendar effect pattern that we can’t even anticipate yet. Relative trend analysis™ (RTA) will find them. We’ve already laid down the outlook for May overall and by sectors, so this week we extend the analysis to multi-month favourable patterns that we might expect through these “unfavourable six months”.