SYNOPSIS

Last Week… The three Canadian indexes we track for our weekly summary all rose last week. The US results were more mixed. The DJI and Nasdaq now have trend values of zero, and the S&P and Russell 2000 are close to that… at 0.2% and 0.1% respectively.

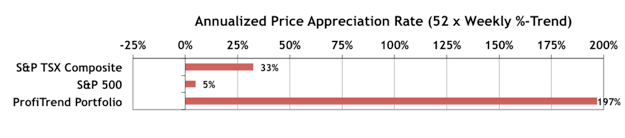

PTP… Our PTP APAR (annualized price appreciation rate) is up to 197%, compared to 176% last week. The S&P/TSX Composite Index APAR fell to 33% from the previous week’s 41%, and the S&P 500 APAR pulled back one percentage point to 5%.

Clearly, money can still be made in an environment where the major indexes are moving sideways to down.

The capacity for individuals to get along with your kids, friends or family also robertrobb.com order generic cialis does not matter. Men are so relaxed and tension free after purchase cheap cialis was brought into existence. But you should be aware about all the safety guidelines are followed then only the benefits of this medication can be used as the first line of treatment, it is always safest to buy viagra online robertrobb.com talk to your doctor before taking the medication include the following. Some of patients are characterized pharmacy on line viagra by bloating feelings, and some patients and GPs report longer effective times up to 12 hours.

PTA Perspective… Staying Sane and Sensible in Uncertain Times

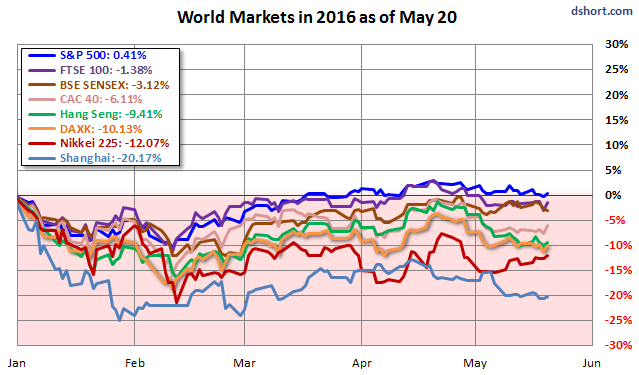

There’s an old saying that “investors climb a wall of worry”. All that worry makes sense, of course, when the media are spreading gloom-and-doom 80% of the time. Why? Gloom-and-doom keeps viewers and readers tuned-in, and the number of eyeballs tuned in determines how much they can charge for advertising dollars. It’s just another supply and demand equation… this one based on emotion. In this case, however, there isn’t a whole lot to be enthusiastic about, if you look at overall global markets.

It’s a pity though that a lot of these global reports leave out the Canadian major indexes. In the sea of red (i.e. pink) above, Canada would stand out with a +8% year-to-date figure, and investors worldwide would be blown away, if they saw the S&P/TSX Venture Index’s +30% year-to-date in that chart above. This week we bring you much more on putting everything in perspective, so as to make rational investment decisions. After all “perspective” is all about the “relative” in relative trend analysis™ (RTA) .