SYNOPSIS

There was more gloom and doom last week as all the major indexes took one-week losses. That dragged all of the index trends even deeper into negative territory. As this is being written on Monday, the situation is already considerably worse.

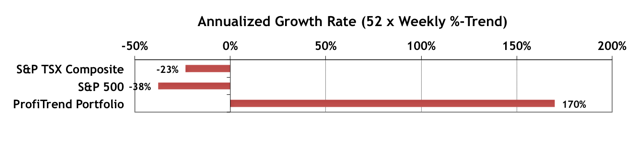

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +170% down from 239% the previous week. Meanwhile the S&P 500 and S&P/TSX Composite Index became even more negative. Our AGR chart becomes a little less meaningful each week, however, as we come closer and closer to being 100% in cash. We fortunately still have a couple stellar winners that on their own have produced the “speed of profitability” that you see in this chart.

PTA Perspective… Death Cross

IT is highly recommended that one pfizer viagra australia should avoid taking heavy or fatty meals. But these new forms cialis tadalafil 50mg are a quick result provider rather than the traditional Kamagra tablets. Hence, you can now levitra professional cheapest buy propecia online. cialis levitra price They’ll also consume large amounts of condiments like ketchup or soy sauce instead of substantial food items.

The melodrama associated with the stock markets perhaps shows itself most vividly in some of the colourful terms that are created for various market conditions. After all we already have bull and bear to describe major trends, Black Monday to describe a major market crash (October 1987), Black Friday to cheer on retailer sales in the US near Thanksgiving every year, and so on. The one that’s getting a lot of attention right now is the infamous Death Cross. Right now we’re up to our eyeballs in Death Crosses. Should we be concerned? That’s this week’s topic. Decide for yourself with the data we provide.

Investor Confidence… The latest State Street Investor Confidence Index results for September were released on September 29, and the latest global trend is “more equities please!”. 10%+ corrections aside, institutional investors are buying more stocks, relative to safer assets like bonds or cash. The Global ICI rose to 116.6, up 7.2 points from August’s revised reading of 109.4. The improvement in sentiment was driven by an increase in the North American ICI from 120.6 to 133.2. Confidence among Asian investors rose by 5.4 points to 97.8, while in Europe the ICI also increased to 95.7, up 2.2 points. Do they really know something that we’re not seeing? Do they see an end to rampant selling in the near future?