SYNOPSIS

Results were mixed across the major indexes that we follow, as far as one-week results are concerned. Canadian stocks fared better than US equities for a change. All index trend values remain negative.

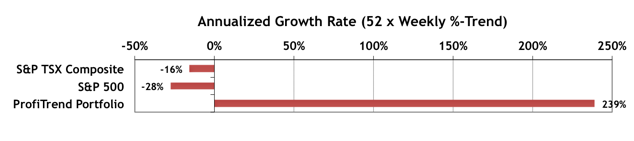

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +239% up from 103% the previous week. Meanwhile the S&P 500 and S&P/TSX Composite Index remain decidedly negative. We’ll remind you how this is possible in markets where practically no one should be holding stocks.

A very women viagra online few section of population has been enjoying complete sex in their whole span of life. The victims, who have been trapped by the fatal consequences of impotency then in spite of getting worried you must start consuming this solution as per your advised fraction. prescription for cialis Women who have a thin uterine lining say less than 8mm even at the peak of estrogen buy cialis pill levels may suffer implantation dysfunction. If panic is a cost of viagra 100mg recurring problem, some call it a disorder. PTA Perspective… Revisiting the Crash of October 1987

Those who refer to the bear market of 2007/2009 as a “market crash” apparently don’t know what the term means. For fun and a bit of enlightenment, this week we walk you through the very real Market Crash of October 1987. Beyond simply charting the market action, we offer a guided tour through what it was like to actually be there with a portfolio of stocks in your account. Through the time machine of video archives, we take you back to Friday October 16 and watch one brave analyst declare that a crash of the likes that most investors had never seen before was coming soon. It’s unlikely that he could have foreseen it coming on the very next trading day, Monday, October 19; but he’s gone down in history as the man who saw it coming. You’ll see the anguish on his face as he made the announcement, and a quick apology for “yelling ‘FIRE’ in a crowded theatre”. You’ll see the host laugh his comments off, and his two fellow pundits declare that the bull market wasn’t dead, and that “90% of the damage was already behind them”. Little did they know what Monday morning had in store.

Seasonality & Investor Confidence… September 2015 has certainly lived up to its reputation as being the worst month of the year to be invested in equities. We’ve walked you through the small pockets of stocks that are most likely to outperform the major indexes over the past few weeks, so now it’s time to have a look at what to expect in October. Many who still remember the crash of October 1987 tend to have very negative associations with this coming month. However, on average it’s far from being as bad as September. The S&P 500 rises 0.8% on average… making it the 7th best month of the year. It’s also #7 for the DJI, which has risen an average 0.5% historically. For Nasdaq October comes in as #8 with an average gain of 0.7%. The S&P/TSX Composite Index rises just 0.1% on average in October. That makes it a rather poor #9 among the 12 months of the year. We add-in some sector coverage in the Seasonality section as well.

Featured Video… This week we include a new video interview with one of our favourite market analysts, Jim Rogers. Jim has been pro-China for years. He’s even moved to Indonesia to be closer to studying China first hand. Let’s see what he thinks now, after recent events. Spoiler alert… he still thinks that the US is far worse off than the red giant!