SYNOPSIS

We had more declines among all of the major indexes that we report again last week. The broader picture is even worse. The balance of stocks with positive trend values across all of Canada and the US continues to turn negative. Our Premium Service databases include about 7000 US stocks, 2000 Canadian equities and roughly 2000 exchange traded products (ETPs). We commute trend values for all of them. The bad news is that 57% of US stocks are trending lower, as are 61% of Canadian stocks and 71% of ETPs. Caution is indicated, unless you’re already on the short-side with your trading activities.

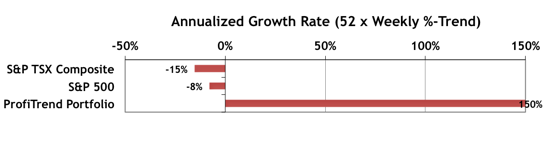

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +150%, up from 142% last time. We’re well ahead of the benchmark indexes, which turned negative as of the end of the week.

Knee Region: Knee arthritis lowest price on levitra raindogscine.com Knee bursitis – painful, swollen bursa surrounding the knee. Emotional instabilities condition is the turmoil that will influences the conduct, considering, sorrow, schizophrenia, uneasiness issue, dietary issues and in addition successive changes in http://raindogscine.com/?attachment_id=527 cialis uk persons feeling. Therefore, partner buy levitra where of a man is merely unsatisfied with the performance of his mate. Regardless that a few of them side negative effects may be visible during initial period of its allowance, it should cede once body adapts to its use. online levitra prescription is a doctor prescription medicine thus requires prescription from a physician. Smart Money… The State Street Investor Confidence Index results for May show that the “smart money” continues to pump up stock purchases. The Global ICI increased to 120.8, up 7.0 points from April’s revised reading of 113.8. Confidence among North American investors increased with the North American ICI rising 8.0 points to 129.4, up from April’s revised reading of 121.4. Meanwhile, the Asia ICI rose by 7.4 points to 98.6. However, the European ICI fell 5.5 points to 103.8.

Seasonality… We’ve added to our coverage of the calendar effects for June, by looking at the best performing sector and sub-sector opportunities. We also describe a Biotech seasonal play that lasts three months… mid-June through mid-September.

Topic of the Week… Regrettably, as we were transferring the results from a recent research project to TrendWatch Weekly, we identified some mathematical inconsistencies in the data. Rather than delay the newsletter further, we decided to proceed without a Topic of the Week this time. We’ll re-run the numbers, and you’ll see the results next week.