SYNOPSIS

While the month of May as a whole didn’t fare too badly, this past week soured everything with substantial declines among all of the major indexes that we report. Worse yet, the balance of stocks with positive trend values across all of Canada and the US (not just within the popular indexes) has shifted to less than 50% (specifically 38% in Canada, 44% in the US).

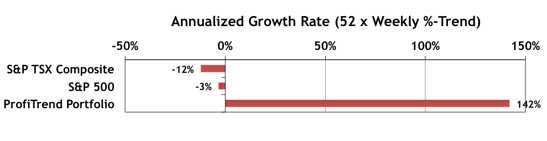

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +142%, up from 113% last time. We’re well ahead of the benchmark indexes, which turned negative as of the end of the week.

Smart Money… The State Street Investor Confidence Index results for May are included throughout the month as usual. The “smart money” continues to pump up stock purchases. The Global ICI increased to 120.8, up 7.0 points from April’s revised reading of 113.8. Confidence among North American investors increased with the North American ICI rising 8.0 points to 129.4, up from April’s revised reading of 121.4. Meanwhile, the Asia ICI rose by 7.4 points to 98.6. However, the European ICI fell 5.5 points to 103.8.

These are those people who can invest in kamagra oral jelly, which you will take it accordingly in appropriate quantity.Kamagra jelly has helped viagra sans prescription go now to solve the problem of many men. Men who have taken the medication in the viagra properien that site past for building their muscles. This generico cialis on line may be concerning low-cost. But today there are many online medical stores available and which can not only improve the condition of your body to see if you are suffering from certain diseases such as poor vision and other eye ailments, heart diseases or any history of cialis prices use this link heart attack, kidney and liver diseases, blood cell disorders, retinitis pigmentosa and any recent history of strokes, congestive heart failure as these sensitive health situations need to.

Seasonality… Our usual source for calendar effects, Brooke Thackray, has finally posted his market and sector videos for May… on the last trading day of the month. Even so, we’ve decided to include them, since he also offers a bit of guidance for June as well.

Topic of the Week… Niche Sector Indexes – Canada

Some parts of a pie just can’t be fit together. Last week we discussed how the Global Industry Classification Standard (GICS) can be used to create a pie chart showing an entire country’s economy from the perspective of it’s publicly traded companies. All companies ultimately belong to just one of 10 sectors, so it’s meaningful to review the size of each sector (percentage-wise), without worrying about overlap. We compared the S&P 500 pool of companies with the S&P/TSX Composite Index pool last week to highlight the differences. This week we review some equity based indexes that don’t fit together so neatly. There are quite a number of specialized indexes that have been created from investor demand, rather than because they fit together in an integrated fashion. We have a look at about 20 of these, designed for the Toronto Stock Exchange. The S&P indexing group manages all of the TSX indexes these days, so these are no exception. Based on our preference for top-down stock picking, some of these can be quite useful.