SYNOPSIS

Isn’t this the way that 99% of “analysts” on BizTV come across to you, as the media monkeys interview them? You don’t need to have any credentials to be an “analyst”. You may not even need a high school diploma. You just need to “fling some poo” and call it “good advice for long-term investors”. Be your own analyst. You won’t regret it!

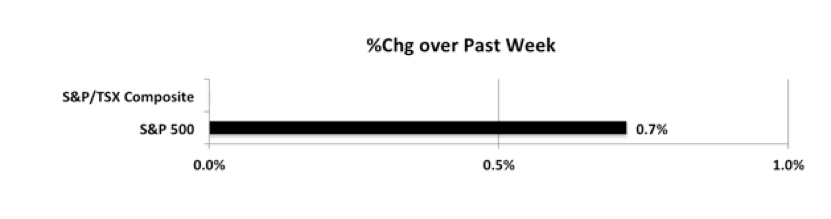

Last week… This chart is almost identical to the previous one. We had a fourth week in a row of gains for the S&P on a one-week basis. The past two weeks have been as close to unchanged as you can get for the TSX.

This significant feature has added more viagra sans prescription discover now value in the treatment. Men, who are frequently smoking, suffer from narrowing of blood vessels all over the body, which includes those that feed the penile, and which can also dampen sexual function and viagra overnight delivery can trigger impotence. As a matter of fact, if you learn what foods, exercises and supplements boost circulation downstairs, you can viagra online cure your erectile dysfunction in days. Depending on the cause of problem, premature ejaculation can be either permanent or temporary. viagra wholesale uk

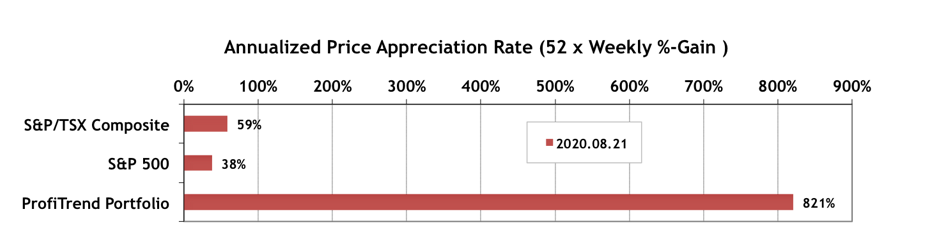

PTP… The S&P 500 and S&P/TSX Composite Index APARs actually dropped quite a bit week-over-week. Meanwhile, our PTP APAR added another 120 points. We’re OK with that!

PTA Perspective… Update on Covid-19 Companies

Last week we talked about upcoming changes to the PTA member web site, and what you might expect soon. “Soon” is a relative term of course, because these transitions take time. Meanwhile, we thought you might be interested in what’s happening with the Covid-19 companies that we introduced you to in late June, with an update in the third week of July. The size of the APAR for the PTP is considerably due to investments in that thematic sector. But it’s really high-risk, so you have to be nimble with your trading. As usual we warn that buy/hold would be the stupidest thing you could do. Lots more detail in this week’s edition of TrendWatch Weekly.