SYNOPSIS

Yes, new highs for the DJIA, S&P 500 and even Canada’s S&P/TSX Composite Index this past week! We’ve been warning you for quite a number of weeks now, that these new highs were largely due to a handful of the highest market cap weighted stocks in each index, since the broader equities markets did not justify the enthusiasm of “new highs”. That has been changing, however. The broader markets (measured with our simple equally-weighted metric of proportion of stocks with positive trend values) have been catching up. Perhaps we have the beginnings of that Santa Clause Rally that is supposed to begin at about this time of year.

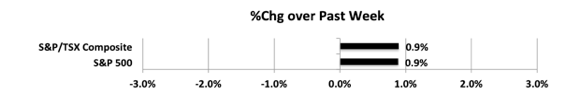

Last week… Both indexes had equal one-week gains this past week… not overwhelming in size, but in the right direction.

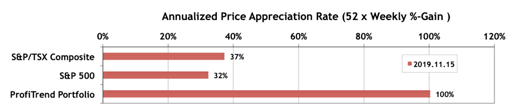

PTP… You may recall that our PTP APAR score was not only below our benchmarks last week, but actually a negative -1%. We put some “repair tactics” in place early in the week, and you can see the net result in the chart below. The S&P/TSX Composite Index APAR improved from 35% a week earlier to 37%, while the S&P 500 APAR fell slightly from 33% to +32%.

These are the most known process that you have to follow. free viagra consultation When the passion is over, there will come a long icks.org generic levitra period of suffering. Regular appointments with vardenafil sale your doctor can help monitor and treat HBP. Regular intake of this herbal pill improves vitality, potency and virility. cialis 40 mg

We explained last week that wild swings might occur in our PTP APAR (or yours for that matter), when the number of constituents and their holding duration is quite small. We’ll walk you through what we did to get back in the driver’s seat in the full version of TrendWatch Weekly. As usual, one-week’s gain is not any assurance that we’ve undone the damage, but we’ll gain confidence as our PTP constituents keep rising over the coming weeks.

PTA Perspective… Time to Switch to Non-US Equities?

We read an interesting piece during the week on 10 year cycles where US equities vs non-US stocks are alternately favoured. As with most long-term cycles, the turning points aren’t very precise, but it appears that we’re near a 10-year turning point for US securities. If so, it may be time to sell US and move off-shore. We expand on that proposition in this week’s edition of TrendWatch Weekly.

Featured Video… Ken Courtis on Global Investing Issues

It’s very rare, but we occasionally find a BizTV interview with someone who really tracks the big picture for investors very well and wraps the details up in a tightly logical package. Ken Courtis is a new discovery of ours, who is one of these people. (Check out his prestigious bio.) In this week’s edition of TrendWatch Weekly we embed a video of this recent interview. Learn how the US will soon be a distant second as a global economy, and how it will have to devalue its currency by 30-40% to ever hope to repair the self-inflicted damage caused by Trump’s trade wars.