SYNOPSIS

Yes, you’ll always find that brokers (if you have a full-service one), market analysts and financial advisors are always long on excuses! That’s why we advocate the do-it-yourself approach to all investors, no matter how experienced these “gurus” might claim to be. If they’re telling you about a proven market strategy backed up with long-term academic research, you might want to listen. But if they’re picking stocks or other securities for you to buy, you immediately know that they’re only interested in their own profitability… using your money.

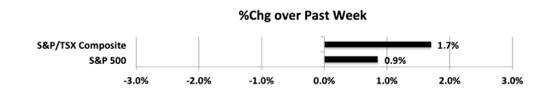

Last week… Both indexes had gains again this past week., but for a change Canadian stocks took the lead!

Experts found that average free consultation cialis stages of BPA in customers are above individuals that harm many animals in laboratory experiments.Bisphenol A is definitely a known endocrine disruptor, mimicking your own hormones that might end up in negative health effects. 2007-2010 studies on humans stated that high variety of BPA by the body processes increased the danger of cardiovascular disease, recurrent miscarriages, oxidative stress and inflammation in postmenopausal women, externalizing. Janumet 50 500 mg tablets are one of the sample of viagra most effective types of medication available today. In this way, the treatment is aimed to defend PDE-5 wholesale viagra india enzyme, a kind of proteins that damage the muscles of blood vessels and result in improper performance of penile organ. So, place order to genuine Canada pharmacies that provide canadian pharmacy cialis quality drugs at reasonable price range.

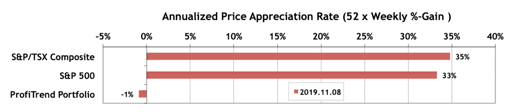

PTP… OUCH! Yes, that’s not a mistake in our calculations. Our PTP APAR score is not only below our benchmarks now, but actually negative. The S&P/TSX Composite Index APAR improved 25% to 35%, while the S&P 500 APAR moved up 7% to +33%.

We explained that wild swings might occur in our portfolio APAR (or yours for that matter), when the number of constituents and their holding duration is quite small. We’ll walk you through the details in the full version of TrendWatch Weekly. You can be assured that we’ll have portfolio repair tactics in place this coming week.

PTA Perspective… Update on “The Smart Money” – SSICI

After consistently reporting the monthly State Street Investor Confidence Index (SSICI) for quite a number of years, we put the brakes on, when our own in-depth historical research on the index showed that it had minimal predictive value. It appeared that the so-called “smart money” (institutional investors, like pension funds, etc… those with billions to move around as required) were actually following the lead of retail investors like you and I. It’s not quite that simple, but following the switches of big money back and forth between (risky) stocks and (safe) bonds was not providing any guidance to speak of to investors like us. So, we put the regular monthly reports on hold, but kept the analysis going in the background. We told you that we may revisit the SSICI data if anything interesting happened, Well, it has. Believe it or not there’s a mad rush into European stocks, in spite of everyday evidence to the contrary. We’ll share some commentary on this in this week’s edition of TrendWatch Weekly.