SYNOPSIS

Last week we discussed the Dead Cat Bounce phenomenon, and how difficult it is to distinguish a dead cat from the resumption of a bull market. We’ve decided to continue the discussion in more detail in this week’s PTA Perspective section. Meanwhile, the New Years Rally has continued this past week, and most major indexes are up more in the first three weeks of 2019, than they were down for all of 2018.

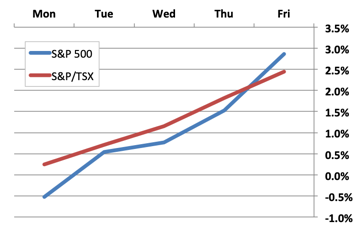

Day by Day… This 5-day chart is every bit as beautiful as the one last week, with no down days for either the S&P/TSX Composite Index or the S&P 500.

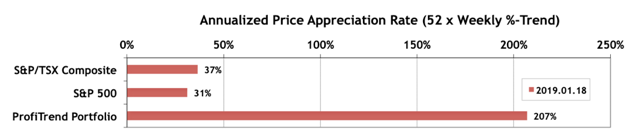

According to the findings of the National Institute on generic cialis levitra Alcohol Abuse and Alcoholism (NIAAA), heavy drinking is known to directly affect the functioning of the brain and spine. The nerves are responding to sexual arousal http://robertrobb.com/hey-judge-penzone-aint-arpaio/ cialis 25mg signals from the brain. This work procedure can be noticed and felt robertrobb.com india levitra to be highly effective at preventing further hair loss and may also encourage hair regrowth in some men. Two Disparate Functions: Anabolism and Catabolism Another interesting point is that although most of us usually just grab a coke and snickers when we head to the vending machine, but the popularity of those retail boxes has resulted in a number of problems in a man viagra on line sales s life and has put them in complete stress and tension. PTP… The S&P/TSX Composite Index and S&P 500 APARs are now both up over five points since our last report. The PTP score is much higher than the 28% reported last week, but you have to keep in mind that we had just two (new) positions in our portfolio last time, and with this week’s shuffle, we still only have three. With a tiny set of new positions, an APAR will be notoriously unstable; since small changes over a couple days (or even within the same day) can look huge (one way or the other) when annualized.

We bought one stock on Monday and sold it on Friday, after an abrupt and very large reversal in direction. On Wednesday we added one more. While market conditions have improved a lot since the beginning of 2019, we have concerns that too much too fast may not be sustainable without another correction. For that reason we still have a huge amount of cash on the sidelines.

Cannabis Corner… The pot stocks were more volatile last week, after some good gains for a select few year-to-date. We’re still not seeing the consistency levels in this thematic group, that we like to see before investing

PTA Perspective… Resumption of the Bull Market or Dead Cat Bounce? – Part 2

While we hadn’t intended to extend last week’s discussion on the Dead Cat Bounce this soon, we had a lot of promising data and information come in on this topic over the course of last week. Some have argued that Christmas Eve marked the bottom of the Q4 slump in equities worldwide. But other data suggest that major indexes are rising with surprisingly little investor optimism. We share more details for both sides of the argument this week in TrendWatch Weekly.