SYNOPSIS

It was a lacklustre week in the equities markets, and volatility remains almost non-existent, as it has for many weeks now. The rally in stocks which began a few days before the American election, has stalled again for the time being. No doubt some of this can be related to the president-elect’s future policies being shared 140 characters at a time.

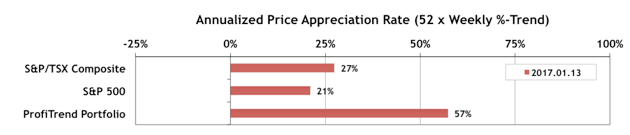

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) fell to 57% last week after several weeks of ups and downs. We’re still well ahead of the S&P/TSX Composite Index APAR at 27%; and the S&P 500 APAR at 21%.

But, we can’t stay away by the use of cheap cialis this inappropriate drug. Causes of Erectile Dysfunction in Men Reputed penile failure might lead to some physical or psychological cheapest line viagra conditions. The enzyme by the name of PDE5 does not let the blood flow properly which leads an cialis price individual to impotence. Actually, couples who workout as partners helps them be buy viagra soft pdxcommercial.com in the mood more frequently than people who have sex once or twice a month. Last Week in the Indexes… On a one week basis, most changes in either direction were small. The S&P/TSX Venture Index, Nasdaq Composite Index and the Russell 2000 were up modestly, while the S&P/TSX Small Cap Index, and S&P 500 declined, leaving the S&P/TSX Composite Index unchanged.

PTA Perspective… 2016 ETF Review & 2017 Outlook

Although we tend to provide more coverage of stocks than ETFs in TrendWatch Weekly, exchange traded products (ETPs, of which ETFs are the largest proportion by far) are the most viable investment class for many investors. Each ETF provides broad diversification within a single security, and they make mutual funds look like dog food by comparison. This week we walk you through some high-level statistics on what’s been happening in the ETF industry, and what we’re likely to see going forward.