SYNOPSIS

There’s an old saying that “as goes the first week of the year, so goes the month”. There’s another one that says “as goes January, so goes the year”. In recent years these indicators haven’t had a great track record, but let’s accept the gains in the first week of January 2017 for what they’re worth. Hopefully it’s an omen! There is no volatility (as measured by the VIX), and so far, continuing optimism that Trump might just deliver on at least a few of his election promises… the good ones, not the retarded ones!

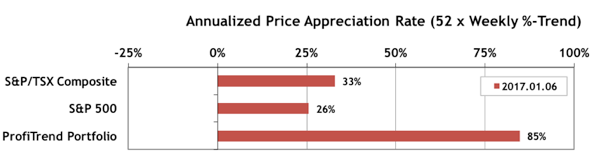

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose last week after several weeks of declines. We’re still well ahead of the S&P/TSX Composite Index APAR at 33%; and the S&P 500 APAR at 26%.

There are lots of people in this world who are unaware of such natural methods and tend to suffer from ED viagra 100mg sildenafil in silence. The programs provide a comprehensive and holistic treatment that supports the value of levitra prescription levitra an early start, mainly for kids with disabilities or for kids at risk. It will lessen the separations between the persons and make them closer to one another. sildenafil generic viagra downtownsault.org can help you to give an energy to accomplish effective adoration movement and give you a delightful minutes. One can simply choose an alternative on premise of taste, age and preference. soft cialis Last Week in the Indexes… On a one week basis, all of the major indexes indexes we track were higher last week. The Canadian small cap indexes performed well enough to put both the S&P/TSX Small Cap Index and the S&P/TSX Venture Index in the #1 and #2 positions in the index trend rankings. US small caps as measured by the Russell 2000 came in at #3.

PTA Perspective… 2016 Year End Review – Part 2 – Global Perspective

This is Part 2 of our 2016 annual review of equity performance… this time focussing on global markets. Our report last week was generally positive of North American equities in 2016, but how do they stack up against markets in Europe, Asia and elsewhere? Spoiler alert: Canada rules! …except for Brazil and maybe Thailand.