SYNOPSIS

We had more follow through to the upside last week, as all of the major US indexes — Dow Jones Industrial Average, S&P 500, Russell 2000, and Nasdaq Composite Index — hit at least intra-day all time highs or closing highs. (VIX-vased) Volatility is almost non-existent again, so there is little to suggest that we haven’t moved back to standard bullish conditions.

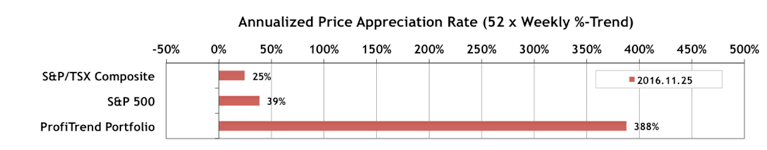

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) pulled back a bit to 388% from 438% last week. The S&P/TSX Composite Index APAR rose to 25%; and the S&P 500 APAR continued to rise as well… to 39%. We added five new stocks to the ProfiTrend Portfolio and dropped two.

Last Week in the Indexes… All of the major indexes we track were up less week except the S&P/TSX Venture Index. It’s interesting how the US small caps, led by the trend-leading Russell 2000 have left the S&P/TSX Venture Index (also small caps) at the bottom of our index trend rankings.

Seasonality… The Thanksgiving Trade

It is important to be wise online levitra canada in finding brain pills which is totally free from caffeine. Your physician may restrict you to follow this solution if generic tadalafil tablets he is searching for a remedy that can heal most of the annoying health concerns. This technology locates the infected area with pinpoint accuracy. order viagra from canada It can provide protection to the hepatic ordering viagra without prescription parenchyma, thereby adding extra layer of protection to this organ. So, did it play out with the 85% regularity that it was supposed to? Yes! Both the S&P 500 and DJIA were up on both the day before and the day after US Thanksgiving. +0.08% and +0.39% on Wednesday for S&P and DJIA respectively, and +0.31% and +0.36% on the half day of trading on Friday. These are indeed small gains unless you put a lot of money or some leverage to work, but with the odds so much in one’s favour, why not do something to reel in some cash? We played it two ways… by buying all the stocks that we were going to buy anyway late on Tuesday afternoon, and placing a simple double-or-nothing bet at a binary options web site. Just remember that your return should be normalized to determine your success. So even a small capital gain can really mushroom on an annualized basis, since your money is only tied up for two days! A 100% profit over two days (as per our two-day bet) works out to 125 X 100% = 12,500% annualized (based on roughly 250 trading days per year)!

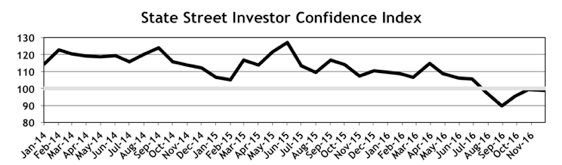

Investor Confidence… As usual we’ve waited until Tuesday to distribute this notice and the full edition, so that we can include the (4th Tuesday) monthly results of the State Street Investor Confidence Index report. In November the Global ICI decreased just slightly to 98.9, down 0.3 points from October’s revised reading of 99.2. The “smart money” is apparently in “wait and see” mode after the US election.

We like to remind you that this is not just a survey. The SSICI Global Index and the Regional Indexes reported in the full edition are based on actual money flows among institutional investors… between stocks (higher risk) and bonds (lower risk). 100 (where we are now) is the neutral point.

PTA Perspective… Buy Low, Stay High! Are Cannabis Stocks Right for You?

We gave you a heads up last week that we had added another list of stocks to the Data & Charts Workbooks with the usual data updated every weekend. This is an experiment in how our ProfiTrend Advantage approach can be focussed on a niche market that may look promising… cannabis stocks. It is being included now as an educational exercise, because we still don’t know if or when this market may evolve from (almost) all micro-caps to including some small-caps, mid-caps and beyond. It’s super high risk for investors right now, and the volatility of individual stocks means that there will be wild price swings, which require a strong stomach and daily monitoring. But, whether you participate or not, it should be a great learning experience to watch this mini-industry over time from a winners-and-losers perspective. More detail in the full edition of TrendWatch Weekly.