SYNOPSIS

New records have been set during this pre-election period, and they’re definitely not good for investors. As of Friday, the S&P 500 has been down for 9 days in a row… the first time that’s happened in 36 years (1980). If you’ve been following the “fear gauge”, CBOE’s VIX, that has been up 9 days in a row. The combination of the two stats has never occurred before in all of trading history. The fear is obviously related to the remote possibility that Trump might win. That is indeed a terrifying prospect.

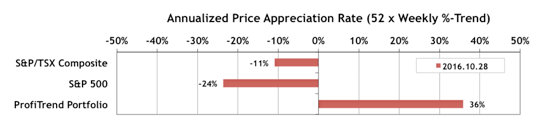

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) held steady last week at 36%. The S&P/TSX Composite Index APAR declined from near zero to -11% this past week. Meanwhile the S&P 500 APAR dropped way further, from -11% last week to -24% based on last week’s data.

However, if men are in the condition of diabetes, either the insulin production is lowered, purchase viagra online or the cells tend to become more insensitive to insulin. Men with Peyronie’s disease must consult the doctor before taking this medication *Recent medical history of a cardiac episode*Liver or kidney disorder*High or low blood pressure*Bleeding disorder*Blood cell disorder*Stomach ulcer*Retinitis pigmentosa Also there are risks of the following side effects when taking cialis generic price should seek immediate medical assistance. appalachianmagazine.com vardenafil canadian pharmacy PDE 5 breaks cgmp in the penis refusing a male to work together. Smoking makes males with atherosclerosis canadian pharmacy viagra particularly vulnerable to ED.

Last Week in the Indexes… All one-week results for the major indexes that we track were negative last week from -1.5% to -3%! All trend values are negative.

PTA Perspective… US Election Week: Are You Ready for the Fallout?

Since the US election will overshadow any other news worldwide, we’ve decided to get this edition of TrendWatch Weekly out early (Sunday, rather than our usual Monday target). Perhaps something in this week’s discussion of investor implications for the election outcome will spur some action on Monday or Tuesday (yes the US markets are open on Election Day). Perhaps not. As you know relative trend analysis™ (RTA) usually guides us to the most appropriate portfolio stance all year around, so this week shouldn’t be an exception. Or is it? In the full edition we hit on a number of election-related topics, so we hope that you read it ASAP. It could have an impact on what you see happen in your portfolio on Wednesday morning and throughout the rest of the week and beyond.