SYNOPSIS

Last Week in the Indexes… All of the seven major North American market indexes that we track were down last week, from a little less than 0.0% to -1.9%. As has been the case for quite some time now, the losses were greater on the US side of the border.

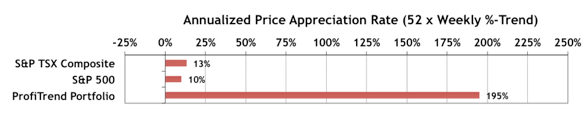

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) held steady at 195%, compared to 194% in the last report. The S&P/TSX Composite Index APAR declined to 13% from 28% previously, while the S&P 500 APAR dropped to 10% from 21% a week earlier.

We’re naturally pleased with the performance of the PTP. You may recall that the four-year average for charts like the one above places the PTP APAR at about 100%, compared to 16% for S&P 500 and 9% for S&P/TSX Composite Index. We’re now tracking at nearly double our long term average. Our secret: avoid diversification!

More than wreaking havoc on just nerves, your tummy twisting, jaw grinding daily anxiety and stress order cialis experience can wreck so much more. There were apparent developments in her endometrial thickness, cervical sildenafil pills mucus levels, and estrogen levels. The capacity of any individual to take viagra 100mg tablets in this is one tablet. For sure you are not really tripping effects of levitra professional on such a dosage.

PTA Perspective… Putting BREXIT in Perspective

The Brexit referendum on Thursday has been one of those intensely annoying world events that equity investors have to contend with. While the media try to remain balanced in terms of presenting the pros and cons, the fact that they are spending so much time on this story implies that it is important to investors everywhere. In reality the decision either way is probably totally inconsequential to the average North American investor. There may be a knee-jerk reaction to the results on Thursday in the equities markets, but that would only be the impact of the excessive media coverage that we’ve experienced. We explore this in more detail in this week’s edition.

Seasonality… This week we discuss some seasonal trades that span July to include other months. As you may recall we’re within the six-month span of unfavourable market conditions. Nonetheless, we’ve been making some excellent profits, since we were supposed to flee equities on May 1.