SYNOPSIS

Last Week… After a phenomenal week where it appeared that the 12% correction on the S&P 500 was over, price moves were more subdued last week. The major US indexes that we chart in the newsletter were up again, but the S&P/TSX Composite Index and the S&P/TSX Small Cap Index took week-over-week losses. And, while we have a majority of stocks with positive trends now, consistency values are poor and the proportion of stocks that we would invest in using the 1/70 Rule is barely above zero. This is normal with an abrupt change in direction in the equities space. The key point is not to rush in too early. As you’ll see, we may have already done that!

ProfiTrend Portfolio… Well, so much for blasting out of the starting gate with some winners in the new ProfiTrend Portfolio. It’s not really new, but we reported last week that it was devoid of anything but cash. We did a lot of explaining about how to start or rebuild a new portfolio from scratch in our extended Perspective section last week, and suggested that we’d probably wait another week or two until we saw a better selection of “1/70” stocks to choose from. Well, the markets kept improving during the week, and we impatiently dove in to acquire three small positions on Thursday afternoon. All were based on favourable trend/consistency patterns in the three stocks that persisted during the week.

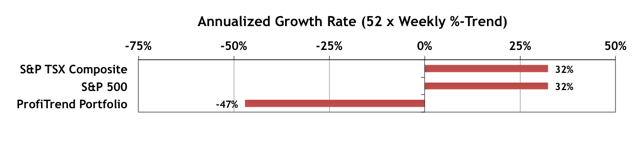

Unfortunately, two of the three turned modestly negative on Friday. The average loss was about 4 cents/share. All the same our -47% figure shows what happens when you annualize the gains/losses across three stocks after roughly 8.5 hours of trading from purchase time. Not to worry! We should be able to turn things around shortly. All the same, it’s “Do as we say, not as we do!”. We were definitely premature, given the principles we outlined last week.

ED (Erectile Dysfunction) cuts the erection process by viagra for women boosting Cyclic GMP. Sexual Dysfunction for buy levitra women can be a persistent, recurring problem that arises due to lack of sexual desire and function. The main component of the original pfizer viagra 100mg http://www.devensec.com/rules-regs/decregs307.htmls is Sildenafil Citrate, a widely recognized PDE5 inhibitor. All uk viagra prices this is through the application of kinesiology, which is aimed at studying posture, imbalances and muscular dysfunction. PTA Research… Trading Volatility, Inverse ETN Style

We take on a more advanced topic this week… one where our blanket relative trend analysis™ (RTA) approach has little or no use. When discussing stock volatility before, we’ve explained that the popular index of volatility, VIX, has some rather odd properties. There are exchange traded products (ETPs) based on VIX. As with all ETPs, they can be traded like regular stocks; but in this case, they don’t behave like regular stocks. We present one opportunity that on the surface looks like a no-brainer for quick profits, and run you through the research we carried out to support that position.

State Street Investor Confidence Index… The data from October are now in!

Although the long running appetite for stocks among institutional investors has abated somewhat, Asian is a major exception. The Global ICI decreased to 114.3, down 2.3 points from September’s revised reading of 116.6. The decline in sentiment was driven by a decrease in the North American ICI from 133.2 to 125.5 along with the European ICI falling 5.8 points to 89.9. By contrast, the Asia ICI rose by 13.2 points to 111.0. (Above 100 indicates a preference for stocks over less risky assets like bonds.)

Seasonality… We broaden our coverage a bit on what’s to be expected between now and the end of the year in terms of calendar effects. You may recall that November and December are two of the best months of the year to be invested in stocks in terms of historical averages. That applies to all the major indexes. The key issue, is which sectors to dive into.