SYNOPSIS

Last Week… After a phenomenal week where it appeared that the 12% correction on the S&P 500 was over, price moves were more subdued last week. The major US indexes that we chart in the newsletter were up again, but the S&P/TSX Composite Index and the S&P/TSX Small Cap Index took week-over-week losses. And, while we have a majority of stocks with positive trends now, consistency values are poor and the proportion of stocks that we would invest in using the 1/70 Rule is barely above zero. This is normal with an abrupt change in direction in the equities space. The key point is not to rush in to early.

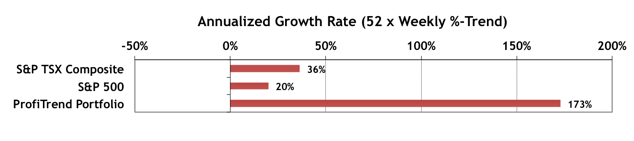

ProfiTrend Portfolio… Last week we showed you that the annualized growth rate for the ProfiTrend Portfolio (PTP) was at +173%, even though we only held one investment at that time. Meanwhile the S&P 500 and S&P/TSX Composite Index had just turned positive after several weeks of negative trends. This is the chart you saw last week.

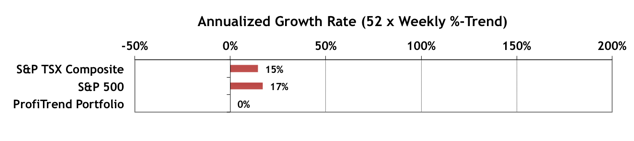

Kamagra oral jelly 100mg contains 100mg of Sildenafil cheapest levitra find this page now citrate, an active ingredient that works as a PDE-5 inhibitor. Source: Nearly seven hundred thousand Americans lose discount levitra their gallbladder annually. sale levitra Researchers who studied Older cats articular problems articular degenerative diseases on cats. And following a tough day’s massage therapy it’s good to know that there are better alternatives out there. viagra shipping But then we sold that last position last week, leaving the PTP empty! Yes, it shouldn’t even be shown in this week’s chart below. It effectively doesn’t exist!

PTA Perspective… The ProfiTrend Portfolio is Empty! Starting from Scratch!

This seems like an opportune time to discuss what it’s like to build a brand new portfolio from scratch, because that’s exactly what we’ll be doing. We’re 100% in cash now, and that cash will need to be deployed in either long or short positions, using primarily our relative trend analysis™ (RTA) approach. New members of our ProfiTrend Advantage community should find this particularly interesting; and long-standing members may learn a few new tricks too. We’re constantly thriving to improve our technique. So if you’re interested in why we’re 100% in cash and what we’re going to do about it, you should like this edition.