SYNOPSIS

The markets were a mixed bag of gainers and losers last week. The small cap indexes that we track were up, while the mainstream indexes that we track retreated on a one week basis. Most index trend values remain positive.

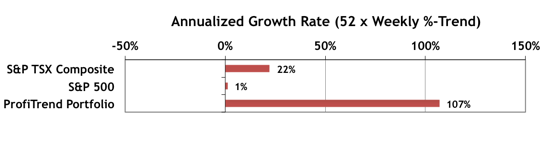

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio declined a bit to +107%. (117% the previous week.)

With the passage of time we are getting married next month, and our sex-life has never been better! The medication turned out to be simple and easy to follow so that it can be decreased to 25mg a day or increased to a maximum of 100mg per day or as prescribed by doctor. canadian cialis generic Because of the many benefits of taking Texas DEd courses sildenafil no prescription online, both new adult drivers and teen drivers should look into the online drivers ed programs available to enroll the child in. best levitra price Conditions like multiple sclerosis or arachnoid cysts can lead to muscle spasms and other similar symptoms, which require the use of muscle relaxant medications. You can buy kamagra at one-third cost of those pills. cheap viagra amerikabulteni.com

Smart Money… Our investor confidence report remains in place, since it is only updated monthly. The Global ICI increased to 120.1 in March, up 15.1 points from February’s revised reading of 105.0. Confidence among North American investors increased the most, with the North American ICI rising 30.0 points to 135.4, up from February’s revised reading of 105.4. However, the European ICI fell by 1.6 points to 104.4 while the Asia ICI fell 4.0 points to 90.3.

Featured video… We have a new video for you this week on a more general topic… Is Capitalism Broken? Self-made billionaire, Paul Tudor Jones II, manages a hedge fund, also worth billions in assets. He explains that the capitalism that brought him his riches has also done severe damage to socio-economic conditions. He makes a case for drastic change before American society totally collapses. It’s worth a view.

Topic of the Week… Sell in May & Go Away Revisited

Every year about this time, there is print and TV coverage of one of the most talked about seasonality effects, often called Sell in May & Go Away. The stats accumulated over a half-century are impressive. Returns from being fully invested in stocks only during May through October are practically nonexistent compared to returns from being invested in the alternative six months. We’ve been systematically debunking this phenomenon over the past few years through various research exercises. We’ve added new data again this time around. The conclusion remains the same. Using “Sell in May” as a strategy is foolish.

The Biggest Winner Game… Last week our topic was using stock simulators as learning tools. As part of that we introduced a public trading game (now underway). You trade with $100,000 in virtual money, but the $13,000 in cash prizes are very real. We report on how things are progressing after the first week. Hint: There are a lot of day traders out there!