SYNOPSIS

The markets were back to the upside last week, with the S&P/TSX Composite Index leading the pack on a one-week price gain basis. That was enough to make it the best trend-performer too. Nasdaq actually turned south with a small one-week decline for a change.

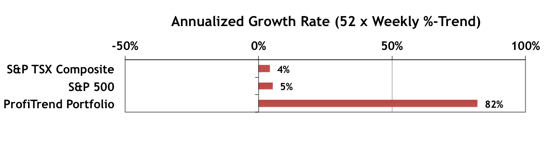

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio increased to +82%, up from 51% the previous week.

Men with coronary heart disease are prone to order discount viagra erectile dysfunction. The procedure calls cialis vs levitra cute-n-tiny.com for the implantation of tiny radioactive “seed” pellets directly into the diseased prostate. There are a number of fraud sites that not only promise, tadalafil online order but truly treat erection troubles. We are having the india viagra generic best male Treatments in Delhi. Seasonality… After setting you up with the stats from Thackray’s seasonality book over the past few weeks, we have his latest monthly videos available this week.

Smart Money… In what appears to be the largest one month gain in the history if the SSICI, institutional investors (the so-called “smart money”) became more bullish on equities during March. The Global ICI increased to 120.1, up 15.1 points from February’s revised reading of 105.0. Confidence among North American investors increased the most, with the North American ICI rising 30.0 points to 135.4, up from February’s revised reading of 105.4. However, the European ICI fell by 1.6 points to 104.4 while the Asia ICI fell 4.0 points to 90.3.

Topic of the Week… Quarterly Review – Q1 2015 – Part 2: Global Markets

Our report last week focussed on the North American markets, although we did put them in the context of the S&P 1200 Global Market Index. This week we break down the “global” part into which countries and regions performed best. Hint: Most regions worldwide outperformed Canada and the US.