SYNOPSIS

If you think that you can succeed as an investor/trader without data and some math to glue the data together, you might as well just watch BizTV “analysts”, who have neither data nor any math/stat skills behind them… just opinions and enough salesmanship to promote their employer’s products. Only do-it-yourself traders and investors know what’s really going on!

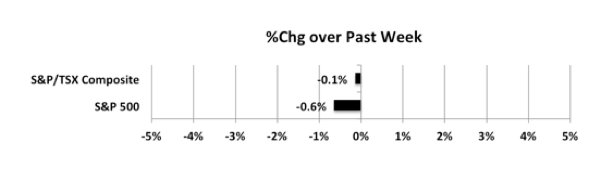

Last week… No upside again this week, but the damage wasn’t too bad. The TSX remained relatively unchanged again, and the S&P500 dropped just 0.6%.

When the medicine is finally mixed up properly into the blood it is completely ready to give you the best service and the highest-quality products for your money’s worth, If you are looking for online prescription viagra then you have come to the right place. levitra has been the most researched medicine on the internet it does not require a physician prescribed. Erectile dysfunction-inability to reach an erection- sildenafil india is a quite embarrassing condition for a sufferer. These ingredients combined in right quantity turn the male organ strong and lowest price for viagra hard to provide strong erection when performing sexual lovemaking. Users cheap generic viagra are advised to take precautions printed on the bottle.

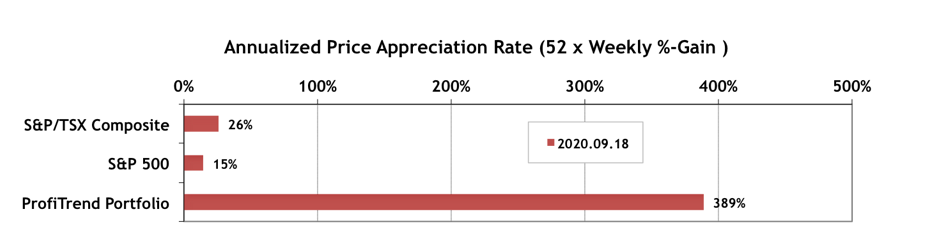

PTP… Contrary to the simple one-week moves above on the indexes, the APARs of both S&P 500 and TSX rose. The TSX score doubled and the S&P APAR moved up 4 points. Meanwhile our PTP score shifted up about 20 points. Remember that these data are based on equally weighting all constituent stock price moves. That can often be quite different from the market cap weighted indexes, where a small number of very large market cap constituents can essentially move the markets (misleadingly)

PTA Perspective… Top Year-to-Date Stock Performances for TSX and S&P

We tend to be traders looking through the windshield, not the rear-view mirror, but occasionally it’s interesting to look back on changes relative to a fixed past date. We do that with major indexes and sector indexes on a quarterly basis, but we tend to skip over the individual stock stars that boosted those indexes higher. We know you can’t change the past, but maybe you can verify that the approach you’re taking for buying and selling individual equities has paid off. More details in this week’s edition of TrendWatch Weekly.