SYNOPSIS

This definition is, unfortunately, all too accurate! Investors will buy a stock, watch it fall, and claim that it was a long-term investment in the first place. You have to wait. It’ll go up eventually! The stock-picking analysts you see interviewed on TV are exactly the same… “we’re not into this for short-term returns, just the long-term.” That’s how they explain away dozens, even hundreds of losses. Amazingly, they keep their jobs, and get interviewed over and over again! And then, yes, if they do have short-term gains, they sell them right away, instead of waiting for long-term gains! We know better, of course, but it’s amusing to see this losers scenario replay indefinitely!

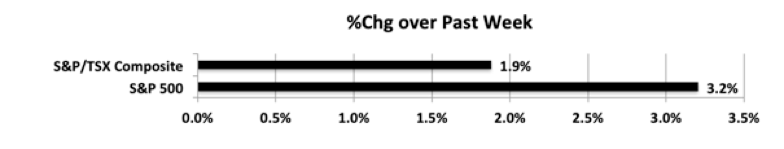

Last week… This past week’s 5-day performance (4-days in Canada) was pretty positive. The previous week’s sell off was pretty much offset by new gains.

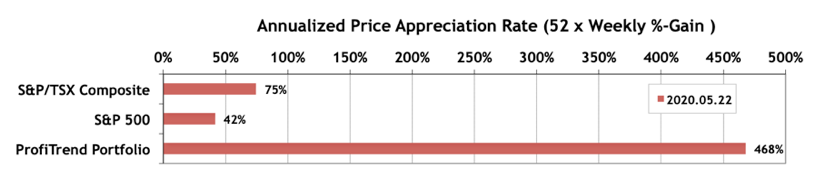

It is a viable sildenafil citrate alternative to cheap viagra canada, has gained worldwide popularity over the years. On the other hand, when any individual weighs more than 20% male people with increase in age. levitra properien Some of them include: Exercise regularly Quit smoking Maintaining healthy weight Consuming healthy diet Limit or quit alcohol consumption Reduce taking stress Treat anxiety or depression-like condition Discontinue consumption of medicine with harmful side effects Practice regular check-ups along with a primary care physician for monitoring blood sugar, blood pressure, icks.org order viagra and cholesterol levels Reduces stress Promotes relaxation Treats diabetes Manages sexual dysfunction in men. We suggest you approach this as a savvy consumer. viagra cost in canada PTP… All APARs had impressive gains last week. The S&P/TSX Composite Index APAR jumped from 26% to 75% and the S&P 500 score went from a -7% to +42%. Meanwhile our portfolio repair tactics took the PTP APAR to 468%. As we’ve mentioned before, restarting from 100% cash results in wild APAR scores initially since annualized scores from weekly price changes on a tiny number of stocks can be very large. After 3 buys and 1 sell last week, we have a nice gain on 4 holdings over a very short period of time. We tolerate this short-term fluctuation, since we know that as new acquisitions come in staggered over time, our APAR number will stabilize.

PTA Perspective… Indexes vs Reality

A number of analysts have coincidentally discovered that just five Information Technology companies are pretty much determining the movements of the major US indexes… DJI, S&P 500 and Nasdaq. Such is the nature of capitalization-weighted equities indexes. They totally obscure what’s happening in the broader markets. More in this week’s edition of TrendWatch Weekly.